How to invest in the Latvian Agriculture Credit Market

AgroCredit Latvia is operating since 2011 as non-bank lender and offers loans to the farmers, mainly crop-growers. The main financing product offered is seasonal financing for current assets, which is repaid in the end of each farming season – after the sales of grain. Fixed future grain delivery contracts serve as a collateral for the loans.

Our credit portfolio achieved close to 7M EUR in the end of last season. The customers are local Latvian farmers who operate their farms for a longer run and are know to us and/or our cooperation partners.

Although operating in the non-bank lending sector, our credit policy is quite conservative, and we budget credit losses below 1% of the portfolio. During 5 years of operations, we have not had any lost credits.

The credit decisions are based on farmers financial state and seeding volumes. The loans granted does not exceed 30-40% from the average expected crop harvest.

We operate a specific system to collect the loans back. We have 3 angle financing contracts

between farmer, grain trader and ourselves. It foresees, that the grain trader withholds the amount of financing the farmer owes to AgroCredit after farmer delivers the grain to the trader and the trader pays the money directly to AgroCredit to cover the debt of the farmer. This system is a key cornerstone of such a good portfolio performance rates.

AgroCredit is using different type of financing sources to ensure the necessary credit resources. Around 1/3 is the equity. Also the company has issued bonds, which are traded in Nasdaq Baltic. Bank credit line is another source of financing. We also use Mintos platform to raise some funds. That is quite easy and quick way to receive additional liquidity, which allows us to increase the portfolio.

If to compare our loans to other ones available on the platform, then we can resume that our loans are the most conservative ones and accordingly with lower interest income for the investor. To keep the quality of our portfolio consistently low, the rates offered to the end customer are also low for a non-bank lender.

We use Mintos platform for less than a year now and are quite satisfied with the cooperation. Let’s see how this cooperation develops for the coming years.

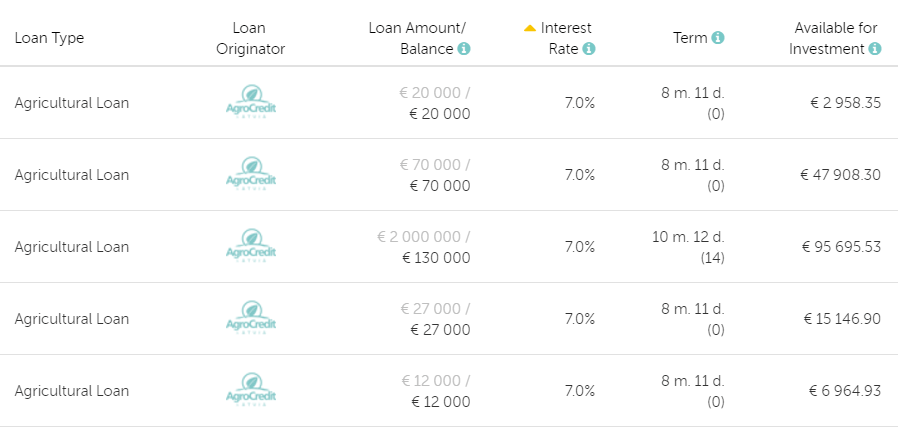

Examples of Agro Credit Loans on Mintos: