Blocknet is a cryptocurrency project. Its aim is to create a DEX i.e. a decentralised exchange in order to solve the risks associated with centralised exchanges.

A cryptocurrency deposit to a centralised exchange is a transaction. Investors deposit the crypto and in exchange, the exchange will owe the investor an IOU for that crypto. Once deposited an investor no longer own the coins, but the exchange owes him/her the coins. While exchanges offer many facilities, they come with risks. The risk is that the exchange might default or get hacked and historically this has meant that investors lose their funds as exchanges can’t get insurance. Centralised exchanges are very high profit targets for hacking attacks and misconduct.

Blocknet is building the framework to have the best centralised exchanges while minimising the risks. Arlyn Culwick one of the lead developers, of Blocknet gives us the details on this very interesting project.

Blocknet has three main components

(1) a Blockchain Router,

(2) an end-to-end p2p data transport protocol,

(3) an atomic coin exchange protocol

The key advantages are:

Blocknet is not only a DEX (decentralised exchange), it is a peer-to-peer protocol between nodes that connects different blockchains. The DEX is its first application.

-

- Trades are done in a fully decentralised manner via autonomous atomic swaps

- No derivatives, multisignatures, or IOUs

- Direct trading via atomic swaps

What is “the DEX”?

From a trader’s perspective, it is the only purely decentralised exchange technology in existence today. From an IT-architectural perspective, it imeansby which inter-blockchain services are monetised.

If you had to explain the saftey of Blocknet when exchanging crypto currencies to a 10 year old, how would you do it?

I guess I’d tell a 10 year old to just use the software and everything will work fine!

Yes, the Blocknet introduces no additional risk of double-spend attacks over and above whichever blockchains it interoperates with. Coins are traded using normal transactions (P2SH) on each blockchain involved in a trade, using normal wallets. At no point do traders entrust a third party with control over their coins.

Who are the core team of Blocknet?

Yes, since 2013, the core team has been public. Dan Metcalf and Arlyn Culwick.

Do the Core Developers have skin in the game?

Yes.

Are you hiring? How can potential candidates apply?

Yes. contact us on contact@blocknet.co or join Slack.

Are the developers full time?

Yes, in the sense that we have several dev contractors, who are not full time employees, but work on the Blocknet in their full capacity.

How is the development team funded today and post version 0.1?

We have self-funded development for the past two years. Our upcoming release (next month) will enable our service nodes to vote to approve a portion of stake rewards or trade fees to go toward development costs, a la the crypto-currency Dash.

One disadvantage of Blocknet is that the the entire blockchain of each coin traded needs to be downloaded in addition to having running wallets. What are potential solutions to this?

We have an SPV multiwallet on our feature wishlist, which will enable people to trade without downloading blockchains. As for the requirement of having running wallets, this may be circumvented via any centralized entity, or, say, a smart contract that processes orders whenever they get accepted. However, we haven’t designed this contract yet, and it’s not trivial work, so it’s not something we can simply put on our roadmap at this stage.

downloading blockchains. As for the requirement of having running wallets, this may be circumvented via any centralized entity, or, say, a smart contract that processes orders whenever they get accepted. However, we haven’t designed this contract yet, and it’s not trivial work, so it’s not something we can simply put on our roadmap at this stage.

SPV is a method for verifying if particular transactions are included in a block without downloading the entire block. The method is used by some lightweight Bitcoin clients. (So you don’t have to download the entire blockchain!)

*Source : https://bitcoin.org/en/glossary/simplified-payment-verification

There will soon be hardfork, are balances on the exchanges safe?

Yes, OP_CHECKLOCKTIMEVERIFY support will launch on mainnet. No risk to coins is anticipated.

(OP_CHECKLOCKTIMEVERIFY) for the Bitcoin scripting system that allows a transaction output to be made unspendable until some point in the future. (This is used to buy the DX time to verify that the transactions are actually going through. 1 trade involves 4 transfers where some refunding is going on.)

*Source : https://github.com/bitcoin/bips/blob/master/bip-0065.mediawiki

Which exchanges have confirmed the switch?

We are on Bittrex’s Slack and will liaise with them as we have done previously.

First mover advantage is important in any cutting edge sector, when can the average cryptocurrency user/trader use Blocknet to trade?

A UI will be released in the next few months, in all likelihood, which will enable the average nontechnical trader to use the Blocknet to trade.

Which nodes will this UI be able to connect to?

Any wallet at all with a stock JSON RPC interface from Bitcoin Core, and support for OP_CHECKLOCKTIMEVERIFY. (This means almost every coin in existence.) Additionally, coins based on Ethereum will be supported.

What are the requirements to run a node in terms of servers (memory, space), coins?

Running a service node is currently almost exactly the same as setting up to trade. You can do it on your local PC, and will be limited only by your storage space. However, since it’s in one’s interest to ensure that service node has excellent uptime, setting up in the cloud would be a good idea.

Are there arbitrage opportunities between service nodes?

No, service nodes to not function as exchanges, they merely provide an order antispam service. Arbitrage opportunities, if any, would be analogous to how high-speed traders physically position their hardware as close to a centralized exchange as possible; in the Blocknet, if you (a) have a high peer count, and (b) figure out how to keep high volume traders as peers, and (c) have the fastest internet connection, then you will be more likely to be able to accept orders faster than others. This, however, is “fairer” than a centralized exchange because it is way less certain where or when high volume peers may appear.

Does one need to have wallets of the tradable keypairs?

Yes, you need to have wallets of only the pairs that you personally want to trade. However, it is unnecessary for you to have either full nodes or separate wallets. An SPV multiwallet will suffice – or, if you’re happy with a lower security level, a thin “web wallet” that merely signs transactions is achievable too.

Is it possible to own a share of a service node?

No. At present, you can only own entire service nodes.

Is the income of a service node public?

Yes, in the same sense that Bitcoin is public: every transaction is on the blockchain, but it’s not necessarily straightforward to identify the physical individuals who control addresses.

Creating a Blocknet node: https://docs.google.com/document/d/1M65hM03tX16FXN-X-30ETWq21WkWts1TxQXv-LR32AU/

How many trades are being executed daily on the testnet?

A volume one would expect during testing.

Do you know of any third party service which will offer node hosting services?

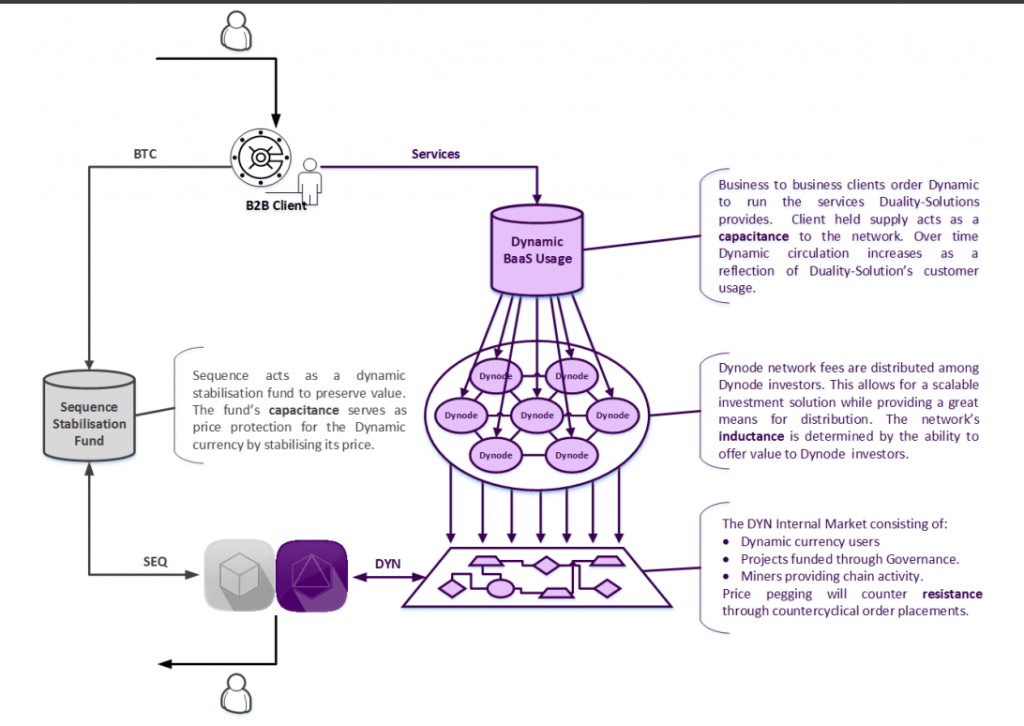

Yes, Azure BaaS is already a partner and we plan to leverage the cloud for scriptable service node deployments.

What has been the most exciting news about Blocknet recently?

Duality solutions will Leverage Blocknet infrastructure for noid. A Health Data Baas.

We thank Arlyn Culwick for the interview.

Find out more on Blocknet:

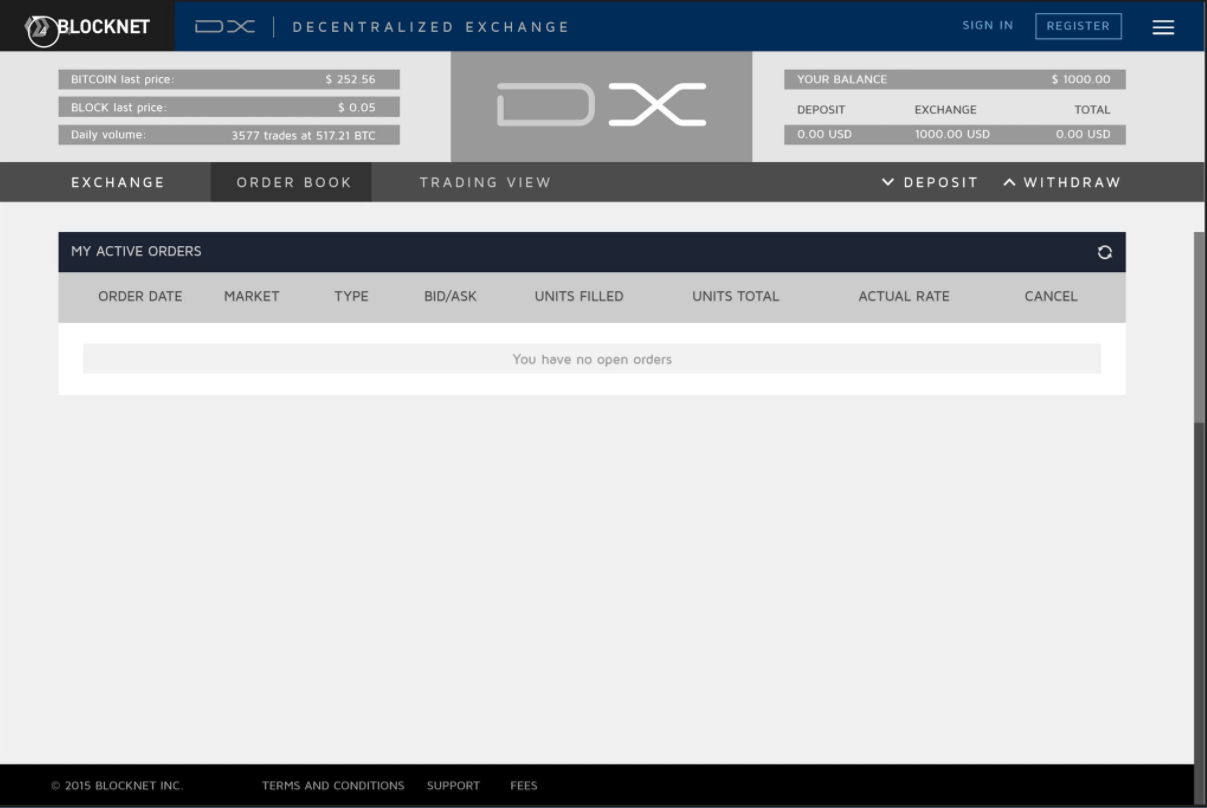

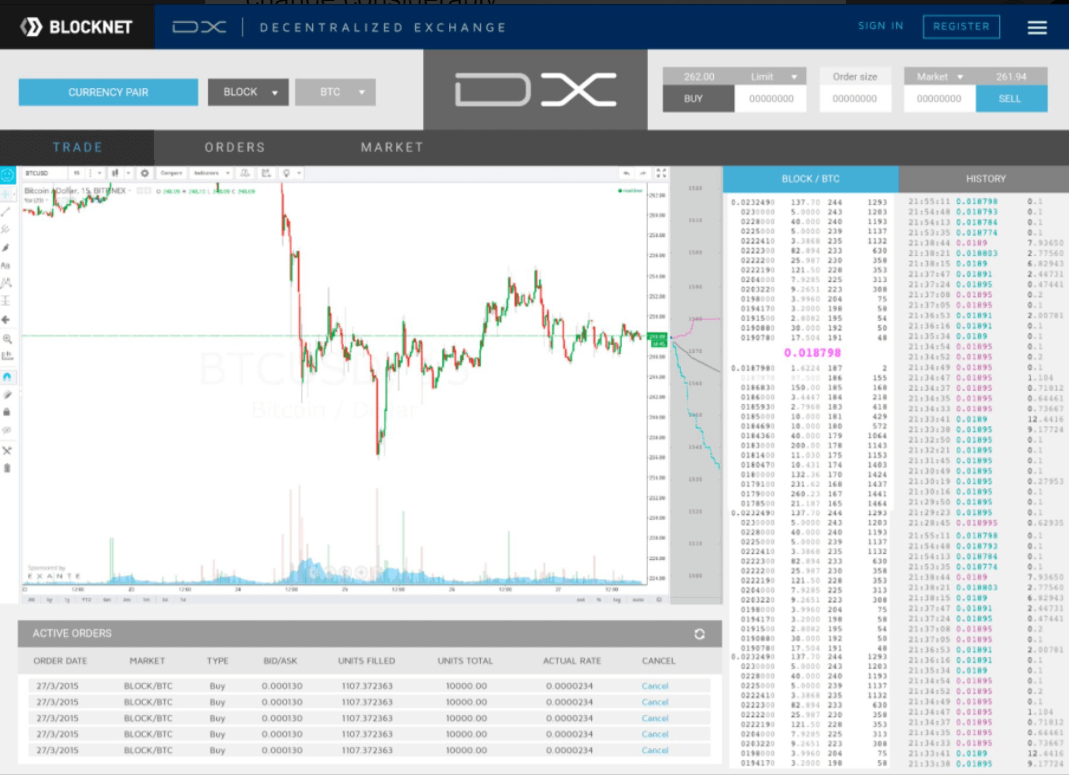

Early mockups: