Review of Capitalia.lv with Juris Grišins

A loan originator on the Mintos

Can you briefly present yourself and the company?

Are are the largest non-bank lender to small and medium enterprises in Latvia, Lithuania and Estonia. To date, Capitalia has financed working capital and investment needs of more than 1000 companies investing over EUR 20 million in the growth of these businesses. Capitalia is a pioneer of this industry and in our region and we have remained clearly ahead of everyone else to date.

What are the greatest achievements for your platform to date, and what was behind this success?

As such we are not a platform but a business lender that uses Mintos as a tool to re-finance our loan book. One of our largest milestones is that by December 2016 we issued EUR 20m of loans financing SMEs. Our growth and success are based on a unique combination of our background in venture capital and commercial bank lending. Mixing such both experiences we have found and developed a successful business niche for companies to use our financing in addition to bank loans or in situations when bank financing is not available.

InvestItIn.com plug – See also: Mintos user guide for dummies.

How would you describe the current financial situation of the company?

Over the last years, we have emphasised growth of the business and have reported an average annual increase of income by more than 50%. This year we will focus on establishing our leading market position in each of the geographies of operations and will focus on boosting profitability. As a NASDAQ Baltic listed company our financials are very transparent and publicly available through Nasdaq Capitalia 12% bond

In what countries are you currently operational? Do you plan to expand further in the future?

Currently, we work in Latvia, Lithuania and Estonia. We have plan on expansion to further geographies, but currently, the focus is on strengthening our position in the Baltic states.

What systems do you use to approve a loan?

We have a proprietary scoring model that takes into account more than 50 individual factors to reach a credit decision. Loan scoring is semi-automated with the final decision being always made by the investment committee.

What are the different peer to peer loan types that Capitalia offers on Mintos?

Our primary scoring is tuned to evaluate historic cash flows of the companies. Hence around 60% of our issued loans do not carry any collateral apart from a personal guarantee from the key owner of the small business. Our typical loan amount is EUR 10,000 and average loan duration is 10-12 months. In addition to standard loans, we also offer invoice financing, where average invoice size is EUR 5,000 and average duration 45 days.

How do the loan repayments you manage compare to industry averages in your country? Are there any specific trends that explain this? What is the current default rate on the loans you issue? How do you manage defaults?

We are by far the leading player in non-bank SME financing in our industry and any other player is relatively new. Hence we are unable to compare our data with the industry average. However, as a result of our continuous improvements in loan scoring and lending policies, we have noticed improvements in smaller defaults each year of our operations. As of 2016, our loan loss rate is around 4% of the issued loans.

Do you have a buyback guarantee scheme? What is your opinion about the buyback guarantee schemes in general?

We offer buy-backs for relatively larger loans to facilitate their interest among the investors.

What is Capitalia’s current “skin in the game” percentage in the peer to peer investment loans offered on Mintos?

Capitali has a 5% investment in each loan.

How do you compare Capitalia’s p2p loans to others p2p loans issued on the Mintos platform?

Compared to most other non-bank lenders available on Mintos I think we can attract investors who seek not only good investment returns but would like to see their money being used to create jobs and boost the local economy through the financing of small businesses. Small businesses are the powerhouse of the Baltic economy. Otherwise, we aim to price our loans similar to other non-bank lenders in Mintos.

What are the advantages of the Mintos platform for Capitalia?

Using Mintos allows us to concentrate on what we are able to do best, while outsourcing IT-intensive solution to Mintos. We are a finance company while Mintos is an IT company. As a result of this cooperation, we have been able to about double our portfolio of loans that we manage. The largest benefactors are the small businesses across the Baltic States, that have been able to finance and invest more in their businesses.

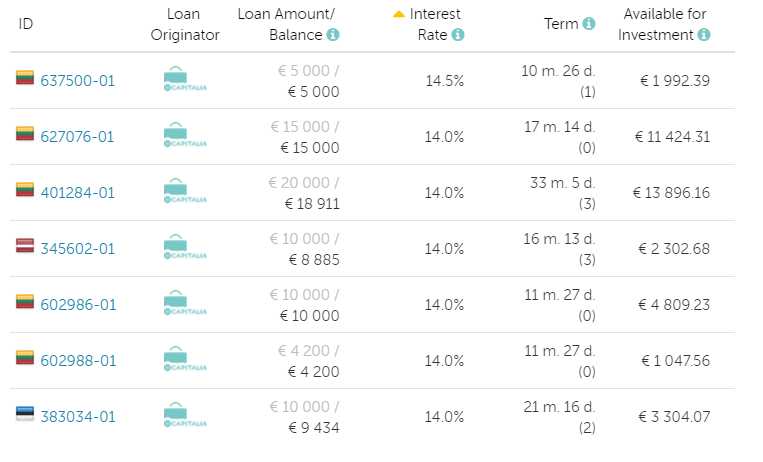

Examples of Capitalia loans on the Mintos Platform:

To find out more about Capitalia and Mintos visit:

We thank Juris Grišins for the interview.