When you want to invest in pooled funds, mutual funds, and Exchange Traded Funds (ETFs) are among the major pooled investment, you’ll come across. Knowing the difference between these two is the key to a good investment.

There is a lot of similarity between ETFs ( Exchange Traded Funds) and...

There are many different ways to invest money. They range from super easy and safe (a savings account), to more complex and risky (stocks and bonds). But there are some investments that should be avoided in all situations. Avoiding these kinds of investments will make it more likely you...

Saving or investing? It’s a never-ending debate in personal finance management, especially now that many economies are struggling to recover from the Coronavirus pandemic. You probably have some money or are making enough money and have some left after expenses that you don’t know whether to save or invest.

We...

While it might be a good idea to have some debts, repaying some personal debts might not be a smooth-sailing adventure. You might find yourself out of a job with lower pay or bedridden with no source of income. For anyone in such a situation, debt settlement could be...

If you are among the millions of individuals who have lost their jobs due to the Covid-19 pandemic, your levels of cash flow may be low. Unfortunately, bills do not take a back seat even when you are at your lowest.

You might not be in a position to postpone...

List of international investments

open to non-resident investors.

P2P Lending

Mintos: A p2p platform based in Latvia

The stock market is an efficient investing machine, the alternative investment market much less so. There are opportunities out there destined for sophisticated, high net worth individuals and the risk-conscious retail investor.

Stock markets on all four...

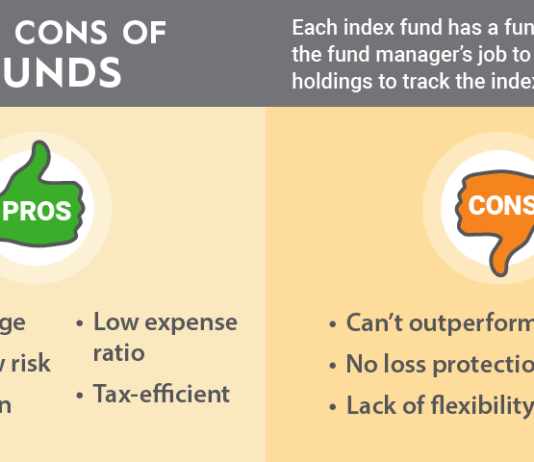

A comprehensive guide to investing in index funds for beginners. Learn the basics, tips, and strategies to make informed investment decisions. Take control of your financial future now!

Life isn’t fair when it comes to money. Some people have a ton of cash while others struggle to just scrape through every month.

When every other brand is trying to sell something to us, the urge to spend our way to social acceptance keeps going north every passing day....

While a loan and a line of credit or credit lines, allows an individual or a business to borrow money to meet certain expenses, the two terms are quite different. Among the shared similarities between those two terms is that the approval for either will depend on the borrower’s...

If there was an award for ‘Most Unlikely Article Title of the Year’ this one would have few competitors beyond Government Decides to Cancel Taxes!

Yet early retirement, or even very early retirement, is a real possibility for those who adhere to the ways of FIRE - and you don’t...

The idea of having an emergency fund is advocated by financial experts who think that having a financial floor is incredibly favorable to cover unexpected situations and emergencies.

Now, is there a chance that you are over-saving for an emergency fund? In fact, there is. If you center too much...

Sometimes, people result in filing for bankruptcy when they have mounts of debts. Debt consolidation, repayment plans, or even saving to pay debts, might not make a difference when one has high debts. With bankruptcy, you can get the option of getting full or partial debt forgiveness.

As bad as...

Americans are more satisfied than ever about their personal finances, according to a quarterly report by the American Institute of CPAs (AICPA).

The institute’s Personal Financial Satisfaction index reached an all-time high of 40.2 in the fourth-quarter of 2019, after plummeting to a record low in the prior quarter.

Personal Finance...

What is peer to peer lending?

P2P lending is a system of direct loans between a borrower and a lender. These direct loans are managed through a peer to peer lending company which has a platform in the form of a website to administer this process. There are many p2p...

If you are lucky enough to have a job amid this pandemic, there is a likelihood that you are still with the work from home (WFH) measures many companies are still practicing. One of the secrets to success when working from home is investing in a comfy and relaxing...

Fintech companies and mobile-money startups have long relied on traditional banks to operate, but that could soon change.

The FDIC approved bank startup Varo's charter application on Monday, which means Varo can start holding customer deposits.

Receiving an official bank charter has been part of Varo's vision from the very beginning,...

Regardless of how your retirement plan pans out due to Covid-19, the truth is that you still have to plan for retirement. Why, because the dynamics of retirement planning have changed over the decade. While the current pandemic might play a role, other factors have changed retirement planning over...

Not all p2p lenders are created the same. Each p2p lender has a different profile; investors need to find the right match between a p2p lender and their financial needs. How do investors select the right p2p lenders? This is a question I cannot answer for you, but I...

Buying a house is one of the most challenging undertakings for anyone. It’s not just about moving from one neighborhood to the other but also the financial management part. Most homebuyers seek financing to pay for a house, leading to a mortgage application.

Applying for a mortgage is not always...

Financial Skills Toolbox

A toolbox is a dangerous place, it contains hammers, saws and nails. If used eloquently they can build your financial fortress. On the other hand, if those using them do not have the experience or the patience to learn how to use them, they can cause unintentional...

![How To Be A Minimalist [Idy On Fire]](https://investitin.com/wp-content/uploads/2019/01/592-Arctcle-100x70.jpg)