Zidisha connects entrepreneurs in developing countries to funds in order for them to accelerate their businesses, further their educations, settle medical bills, and pursue any project which is clearly defined. Our entrepreneurs are of all ages and are in various parts of the world, including on the African continent...

Review of Capitalia.lv with Juris Grišins

A loan originator on the Mintos

Can you briefly present yourself and the company?

Are are the largest non-bank lender to small and medium enterprises in Latvia, Lithuania and Estonia. To date, Capitalia has financed working capital and investment needs of more than 1000 companies investing over...

{

"@context": "http://schema.org/",

"@type": "Review",

"itemReviewed": {

"@type": "website",

"name": "unbolted.com"

},

"author": {

"@type": "Person",

"name": "Jim Reynolds"

},

"reviewRating": {

"@type": "Rating",

...

Minto p2p loan investing for newbies.

Mintos is a peer to peer platform based in Riga. Mintos is not a bank, but it can legally provide loans to borrowers. Investors can also participate in these loans. This participation is known as crowdfunding, whereby each investor buys a small part of...

Swisspeers offers peer to peer loans for SMEs in Switzerland. It was launched in 2016, and to date has issued a total of more than CHF 7’000’000 in loans. Their primary target market is SMEs which require capital to expand, replace equipment and want to expand internationally. In this interview, Alwin Meyer of Swisspeers has answered...

Not all p2p lenders are created the same. Each p2p lender has a different profile; investors need to find the right match between a p2p lender and their financial needs. How do investors select the right p2p lenders? This is a question I cannot answer for you, but I...

What is peer to peer lending?

P2P lending is a system of direct loans between a borrower and a lender. These direct loans are managed through a peer to peer lending company which has a platform in the form of a website to administer this process. There are many p2p...

Interview with Xavier Laoureux, director at Mozzeno, a peer to peer lending platform based in Belgium.

Can you introduce yourself and Mozzeno?

Mozzeno is a Belgian fintech founded in December 2015. We have just launched the first digital platform to enable private individuals to participate indirectly in the funding of loans...

Žltý melón is a p2p platform from Slovakia which offers many opportunities to both investors and borrowers. Through this platform investors can finance several types of loans. Different loans on the platform have different risk profiles which investors can use to set their own interest rates. Žltý melón has...

Peer to peer lending is a system in which borrowers and lenders connect directly to lend money to each other. The internet has become a matchmaker between borrowers and investors or lenders who would like to co-invest in such loans with other investors. Co-investing taps into the power of...

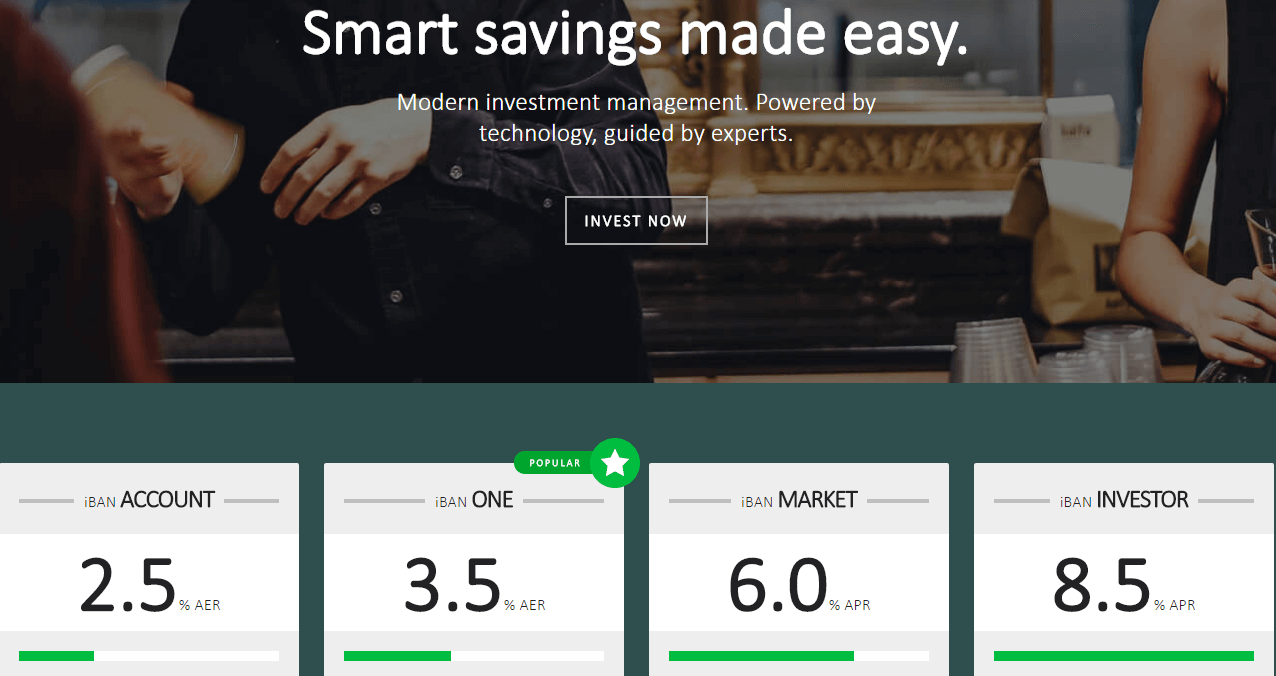

With a range of platforms offering investment opportunities in the world of P2P loans, investors can take advantage of excellent short, medium and long-term ROIs, which far exceed those available in high street banks. Many of these services use automated investment tools to manage portfolios. To help you understand...

iBAN is a relatively new p2p lending investment platform. They are offering an international investment product which is well fortified against borrower default risks. In interview this Mike Phillips, discusses how investors can make the most of the p2p lending opportunities offered by iBAN.

About iBAN:

Can you briefly introduce yourself...

Peer-to-Peer lending is the novel application of technology to one of the most ancient of professions: lending.

The premise of lending is simple: people with excess capital lend money to borrowers who need capital. In return, the borrower promises to repay the debt obligation plus interest at a future date....

Investing in Polish car loans can be done on

Mintos the peer to peer lending platform.

Mintos, 13th February 2017.

Non-bank car loan provider Mogo is expanding its presence on the Mintos marketplace!

Mogo will now offer car loans issued in Poland on the platform. The loan originator will offer investment opportunities in...

Interview with Ivaylo Ivanov, CEO of Iuvo.

What is the mission of Iuvo?

Iuvo strives to deliver a superior experience (singular form) for investors through its vast listed credit portfolio by trusted originators and outstanding platform simplicity. We give numerous opportunities for progressive investing and freedom of choice while focusing on continually...

MiCrowd.es is a for-profit social lending p2p platform, the CEO, Alejandro de León shared his journey with InvestItIn.com.

What is the story behind MiCrowd.es?

In 2009 I started giving scholarships in Nicaragua, I was fascinated by the place and the genuine nature of the people. When I was living there, I had...

When investing investors put their capital at risk. This risk changes according to events in the world. In particular, p2p investing is still a relatively new industry and thus is subject to more changes. Regulators, p2p lending platforms, borrowers, investors, loan demand, borrower choice and interest rates are agents...

Viventor, a platform to invest in Spanish & Swedish p2p loans.

Viventor is a peer to peer loan platform which provides opportunities to invest in p2p mortgage loans and p2p payday loans in both Spain and Sweden. Its function is to match loan providers with investors. As of the time...

Interview with Michael Lynn CEO of Relendex, a peer to peer lending platform, offering asset backed loans to investos.

Can you briefly present yourself?

Michael Lynn, founder and CEO. Michael qualified as a Chartered Accountant in 1971. After qualifying he joined Deloitte in London, later moving to their Paris office. He was...

Zopa is one of the first and biggest p2p lenders in the UK. It has more than 300,000 customers and it plans to acquire more. It has recently applied for a banking license, in order to capitalise on its brand. Zopa’s focus has always been customer centric, becoming a...