Bondora is a European p2p lending marketplace. It is based in Tallinn, Estonia. Estonia is Baltic state which is part of the European Union. A p2p marketplace enables borrowers to borrow money from multiple investors.

Strengths:

Investments Structure:

No fees for investors.

Micro-investments in many loans, spreading your risk across many...

Kuflink has a peer-to-peer lending platform, with all loans backed by property. One of the key features is the significantly large skin in the game for their bridging loan offerings. Tarlochan Garcha answered our questions about this investment opportunity.

Can you briefly introduce yourself and your role/position in Kuflink ?

I am the Chief Executive...

Flender is a social peer to peer lending network. The difference from other p2p platforms is that on Flender the borrowers and lenders often know each other. Flender makes it easy and professional for businesses to invite their customers, family and friends to participate in a loan and to...

Investing in Bulgarian p2p loans

with KlearLending

What problem is Klear trying to solve?

If you deposit money in your bank, you get less than 1% return per year. But ask for a credit and your interest rate will be in average above 10%! The gap is big. For sure, there is...

{

"@context": "http://schema.org/",

"@type": "Review",

"itemReviewed": {

"@type": "website",

"name": "growthstreet.com"

},

"author": {

"@type": "Person",

"name": "Jim Reynolds"

},

"reviewRating": {

"@type": "Rating",

...

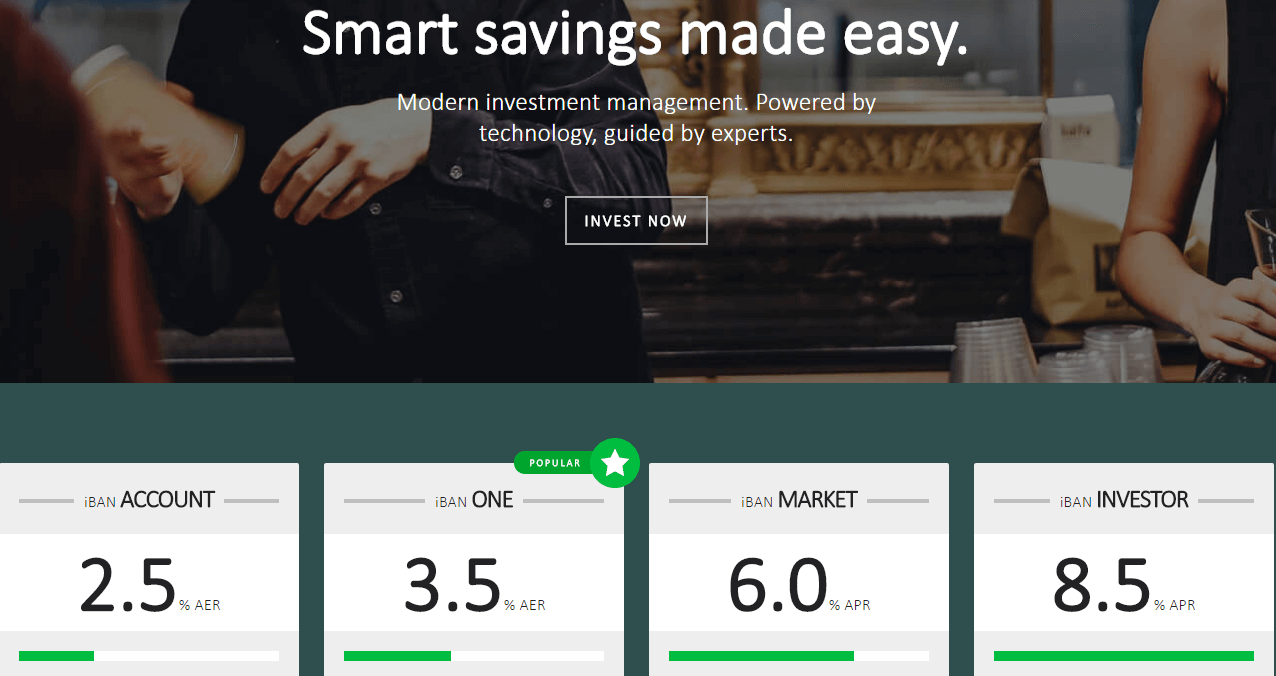

iBAN is a relatively new p2p lending investment platform. They are offering an international investment product which is well fortified against borrower default risks. In interview this Mike Phillips, discusses how investors can make the most of the p2p lending opportunities offered by iBAN.

About iBAN:

Can you briefly introduce yourself...

Fixura is a p2p platform based in Finland, they offer loans investors p2p loans. We have asked Fixura questions in order to help prospective investor build their own review of Fixura.

What is the story behind Fixura?

Fixura is the oldest p2p lending platform in the Nordics. The company was founded 2009 and the...

Review of Capitalia.lv with Juris Grišins

A loan originator on the Mintos

Can you briefly present yourself and the company?

Are are the largest non-bank lender to small and medium enterprises in Latvia, Lithuania and Estonia. To date, Capitalia has financed working capital and investment needs of more than 1000 companies investing over...

PeerStreet is a marketplace that provides unprecedented access to high-quality real estate loan investments. In this interview, Rebekah Jack, marketing manager at PeerStreet, answers my questions in great detail.

What does PeerStreet do?

PeerStreet is a marketplace where investors can invest in real estate backed loans. We purchase loans from private...

Zidisha connects entrepreneurs in developing countries to funds in order for them to accelerate their businesses, further their educations, settle medical bills, and pursue any project which is clearly defined. Our entrepreneurs are of all ages and are in various parts of the world, including on the African continent...

Younited Credit, 1ère plateforme en ligne de crédits aux particuliers en France. Frédéric Chaignon present les opportunités d'investissement avec Younited credit.

Pouvez-vous vous présenter?

Frédéric Chaignon, responsable des relations investisseurs de la plateforme Younited. Après avoir travaillé chez JP Morgan à Paris, j’ai rejoint la plateforme en 2013 afin de développer...

Bondora is an Estonian p2p lending platform; it facilitates lending between peers. On Bondora, Investors can set their portfolio manager risk level to Conservative, Balanced or Progressive. Using this setting investors, do not need to manually select each loan to invest in. There is a third way of automated...

DoFinance is a peer-to-peer lending platform that gives a great alternative to traditional financial services such as conservative bank deposits or risky stock markets to those who want to become their own financial directors. Earning up to a 12% annual return and available to private individuals in all Europe...

EstateGuru is a Euro-based peer to peer lending platform. All the loans listed are backed by property assets and interest rates are above 10%. Triin Jõeleht, investor relationship manager at EstateGuru answered my question in detail. The answers provide insights on how to make the best of this p2p investing...

Viventor, a platform to invest in Spanish & Swedish p2p loans.

Viventor is a peer to peer loan platform which provides opportunities to invest in p2p mortgage loans and p2p payday loans in both Spain and Sweden. Its function is to match loan providers with investors. As of the time...

Zopa is one of the first and biggest p2p lenders in the UK. It has more than 300,000 customers and it plans to acquire more. It has recently applied for a banking license, in order to capitalise on its brand. Zopa’s focus has always been customer centric, becoming a...

Interview with Ivaylo Ivanov, CEO of Iuvo.

What is the mission of Iuvo?

Iuvo strives to deliver a superior experience (singular form) for investors through its vast listed credit portfolio by trusted originators and outstanding platform simplicity. We give numerous opportunities for progressive investing and freedom of choice while focusing on continually...

How to invest in the Latvian Agriculture Credit Market

AgroCredit Latvia is operating since 2011 as non-bank lender and offers loans to the farmers, mainly crop-growers. The main financing product offered is seasonal financing for current assets, which is repaid in the end of each farming season - after the...

Swisspeers offers peer to peer loans for SMEs in Switzerland. It was launched in 2016, and to date has issued a total of more than CHF 7’000’000 in loans. Their primary target market is SMEs which require capital to expand, replace equipment and want to expand internationally. In this interview, Alwin Meyer of Swisspeers has answered...

Investing in Polish car loans can be done on

Mintos the peer to peer lending platform.

Mintos, 13th February 2017.

Non-bank car loan provider Mogo is expanding its presence on the Mintos marketplace!

Mogo will now offer car loans issued in Poland on the platform. The loan originator will offer investment opportunities in...