Interview with Alex Shvayetsky, partner at Caviar.

What challenge is Caviar addressing?

Diversification for cryptocurrency + traditional investors: Caviar is pioneering a dual-purpose token and crowdfunding platform built on the Ethereum blockchain to offer access to a stable real estate and cryptocurrencies, with built-in downside protection and automatic diversification.

What is the scale of this challenge?

There is a growing number of cryptocurrency based products including large ETFs and investment and index funds that offer very little diversification in the highly correlated crypto market, and diversification is an essential component of any portfolio, and is required to mitigate the risk in the long run. However, it can only be achieved by combining uncorrelated asset classes and not by selecting individual currencies or timing the market.

How does Caviar turn this challenge into an opportunity?

Caviar’s experience with operating a successful real estate debt fund for the past 5 years and

existing infrastructure provide a unique opportunity to be able to offer investors exposure to real assets and stable income even during market downturns.

Can you showcase some team members/advisors which have a strong background?

– As an experienced entrepreneur and real estate expert, Caviar partner Guy Neumann uses his related knowledge of development and estimation to run a successful construction company. He holds a Bachelors of Applied Science from the University of Hartford, with a strong focus on finance and economics, all of which he applies to his work at Caviar.

– With a degree in both finance and mathematics, Caviar partner Alex Shvayetsky has 20 years of experience in real estate management, development, and investment, all of which he applies to his work as a crypto entrepreneur. While his strong background and experience have allowed him to successfully invest in equities and other securities, his knowledge of cryptos has been instrumental in his more recent trading strategies. As an early investor in Ethereum, he has participated in over a dozen token-generating events and brings a unique brand of insight to the Caviar enterprise.

– As a serial entrepreneur with several multi-million dollar exits in the IT service space, Caviar partner Kirill Bensonoff brings a great deal of knowledge and experience to Caviar. He bought his first bitcoin in 2013 and has participated in dozens of token-generation events since then. As a graduate from the Entrepreneurial Masters program at MIT, he has served as both an advisor and angel investor in over 20 different companies. Kirill is also a member of the Young Entrepreneur’s Council and regularly co-hosts the Boston Crypto Meetup series.

What is their connection with this particular project?

The founders and some of the advising team have known each other for many years. After running the real estate fund Caviar Capital for the past five years, the team came together to fuse and optimize their skills in technology, real estate and finance to create Caviar.

How does Caviar generate income from flipping real estate or from the buy to let model?

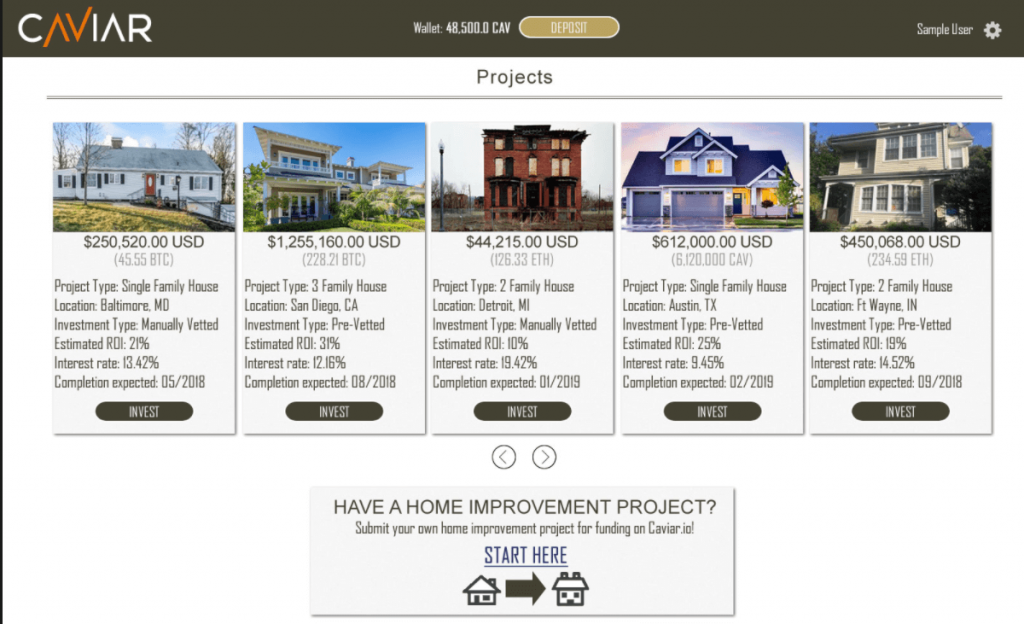

Caviar’s business model on the real estate side is based on lending (we don’t actually own any real estate, but secure it with a first lien position). We have perfected this process over the past 5 years at Caviar Capital. A real estate developer will come to us and present a project, we require certain information. We will evaluate the project, the budget, location, and the creditworthiness of the applicant using a proprietary system we call Cscore.

If the project and the applicant fit our lending criteria, we will come out and do an on-site property inspection. If everything passes, we lend. The way we generate income is Caviar charges an origination fee upfront (usually 3%) and then an interest rate (10-15% per year) on top of that. So our internal rate of return is fairly high, and we beat most similar products by a wide margin.

What business/investment edge does Caviar have to turn a profit on each transaction?

I believe our edge is our people, process and technology. Caviar has 5 years of experience running a similar debt fund, and our team includes entrepreneurs, real estate people, traders, and a Harvard Ph.D. We also have a unique Intelligent Predictive Model, as well as our Cscore mechanism to let us know the creditworthiness of our borrowers. Putting all of these together, in our mind, is a winning formula.

In which areas does Caviar perform real estate transactions?

Today, we are mostly in the Northeastern United States, mostly CT, MA and NY. However, after the token sale, we plan on expanding to other areas, as well as internationally. There are real estate developers all over the world who are asking us to help them get started in the business of buying, improving and reselling real estate.

Are there plans to go international?

Yes, absolutely.

Can Caviar issue more tokens after the ICO?

No, we will have a fixed amount of tokens, and won’t issue new ones.

Will investors need to interact with a smart contract to receive their dividends?

We are still finalizing this, but most likely, yes, they will need to claim dividends. However, please check our whitepaper or social channels for most updated info on this.

What yield is expected from Caviar?

Backtesting and historical returns of Caviar’s weighted top ten large cap and real estate portfolio for the last four quarters show a combined net annual return of 523.68% and expected distribution of $0.21 per token

Does Caviar.io have any strategic partnerships?

Yes, we are going to make some announcements prior to the presale.

Does Caviar.io have a viable product at this time?

Our trading algorithm and real estate products are viable. The crowdfunding platform is a work in progress and we expect it to be ready soon after the token sale.

What is the status or this product?

The crowdfunding platform is in alpha, everything else is ready.

How many users are actively using this product?

Our previous fund, Caviar Capital LP, has financed dozens of real estate projects. Caviar, its’ successor, will go live after the completion of the token sale.

What are the main risks/Challenges to the Caviar.io project and what is the team doing to mitigate them?

The main risks, as with this sector as a whole, is with market volatility. Caviar is designed to address this specific issue by being able to diversify investment between 2 uncorrelated asset classes and shift funds from crypto to real estate during market downturns.

What is the structure of the ICO?

Pre ICO: Nov 28th, 2017 – Dec 5th, 2017

ICO: December 12th, 2017 – January 31st, 2018

Presale Discount – up to 30%

ICO Bonus – up to 7.5%

What are the requirements to participate in the ICO?

We will require everyone to pass a KYC and AML check

What are the pros and cons for the token holders?

Token holders will get quarterly distributions of 75% of net profits via ETH,

20% of the profits will be reinvested, and funds allocated for token buyback to insure additional value growth and liquidity

Is there a pre-ico?

Yes – beginning November 28.

What is the price of the pre-ico and the price of the ico?

Price per token $0.10 with up to 30% discount during pre-sale

How many tokens will be issued?

375,000,000

Is there a cap on the ICO?

$25,000,000

What are your views on real estate market in (area of operation of Caviar)?

Today, Caviar operates mostly in the Northeastern USA. For example, in the state of CT, the real estate market is very robust. There are many opportunities for Caviar’s prospective customers to purchase, improve and resell property.

According to RealtyTrac, a real estate statistics service, foreclosures in CT in June 2017 were approximately 1,400, up slightly from around 1,300 the same time last year. This reality points to a robust market for our partners, who are often involved in purchasing foreclosed or distressed property. Other areas may vary, but overall, the market conditions are very favourable.

We thank Alex Shvayetsky for the interview.

For more information please visit : http://www.Caviar.io