What is an ICO?

Warning: Investing in ICOs (or Altcoins) is an extremely high-risk investment activity. This document is not a recommendation to invest in ICOs

An ICO is an initial coin offering. A coin is a token which represents some value (promised or real. ICOs take place before a project is launched, the funds collected are used to build the product specified in the white paper.

An ICO is generally launched at much earlier stages that an IPO (Initial public offering). IPOs tend to be accessible to only high net worth investors and those within certain networks and connections. On the other hand, ICOs are open to anybody as long as it is legal for them to participate according to the laws they have to abide by.

At times an ICO is also called an ITO (Initial Token offering)

Most ICOs have one or several white papers, that describe a business process, a new currency with added benefits or a token which gives access to certain functionally. An ICO allows investors to acquire these tokens in exchange of other cryptocurrencies usually Bitcoin or Ethereum

ICO’s are open for a period of time, during which investors can buy the new token, in most ICOs early investors are given bonuses

See latest ICOs here: https://investitin.com/ico/

Who launches ICOs?

ICO categories:

- Very well known individuals or groups who have a reputation in the crypto space or finance. These ICOs would be very well organised, marketed and executed at least in the initial stages. These projects would define a clear, unique selling proposition and competitive advantage.

- Smaller groups or single individuals who know their work, but do not yet have credibility. in the crypto space. This category can be a mixed bag of a clear strategy for the founders, but it’s communication to the outside world is weak at best. Some developers in this category have launched under the radar ICOs, with very low pre-mines and fanfare. This allows them to accumulate considerable amounts of their own coin, after which the do publish their true intentions.

- Smaller groups or single individuals who create or clone Altcoins which has very limited improvement on another altcoin, however, they have a very good marketing engine which promotes (pumps) the ICO and the Altcoin. A times the momentum, will snowball and become self-sustaining.

- Amateurs who are well intentioned, but do not have the connections, marketing knowledge, and resources to maintain the project in the long term. Such projects are eventually doomed to fail, with the ICO investors losing all their money

- Scammers who use the unregulated ICOs to prey on the greedy, gullible investor.

Can investors make money from ICOs?

It is possible to both make money and lose money from ICOs, but these are some of the riskiest investments I know of. Investors can make their due diligence, but an ICOs success is dependent on some factors which is outside of the founder’s control. There are an infinite possibility that an ICO can go wrong.

Read my guide: How to analyse and invest in Altcoins.

What are the pros of ICOs?

For ICO Founders – Entrepreneurs

- Raise capital efficiently

- ICOs are much cheaper than IPOs

- ICOs require much less documentation than IPOs

- Branding and marketing opportunity to get exposure for an Altcoin

- Community building

- Create skin in the game with early adopters; this will make them part of the marketing mechanism of the project.

- Entrepreneurs share both the risks and the benefits of their efforts with the investors

- Founders / Developers have a method which can help them finance a project which can make the best use of their skills to the maximum possible extent

- Well respected crypto-experts have a channel to cash in on the skills and credibility they built over the years.

- Proof of stake Altcoins resolve the problem of fair distribution through ICOs, and in PoS the coins come to fruition immediately.

- VC funding is much more intrusive on the founder’s vision

- An alternative to an ICO is borrowing, this has many implications on the project cash flow which is not always possible to manage in altcoin/crypto projects.

For ICO Investors

- Some transparency for example, an escrow can be used to verify how the funds are being spent after the ICO

- Early Investors will have more liquidity in early stage companies

- Early access to a token which has the potential for capital growth

- Not regulated or registered with any government organisation and there are usually no investor protections other than what is built into the platform itself.

- Investors can be part of a community

- An innovative way to deploy capital

- An ICO which uses existing networks such as Stratis, Ardor and Ethereum, are tapping into the network capital of an existing ecosystem

- Divest from main cryptocurrencies into altcoins

- Investors are usually the first users of the altcoin – thus unlike holding a stock of a company whose products an investor never used, ironically altcoins can be a more tangible than other investments

- The returns from investing in ICOs can be in the 1000% and also complete losses

- Diversification into other assets.

- A high risk, high reward investment which is (to some extent) disconnected from the stock market and the economy

- Own an alternative asset not based on FIAT currency

For the Cryptocurrency community

- Altcoins will fuel the race to build Web 3.0. A decentralised web. The internet stack becomes full independent from any central entity.

- Altcoins are at the cutting edge of fintech, even if an altcoin project tech fails. There will be lessons learnt regarding the technology and business model being proposed which will benefit the whole community.

- More competition in the crypto space makes the competitors leaner. Meaning the “invisible hand” of the market frets much faster in terms creative destruction and survival of the fittest the more altcoin projects are launched.

- Intra Altcoin competition is healthy as it prepares the altcoins for the real competition, the crypto-based decentralised projects vs traditional firms.

- There are two schools of thought, Bitcoin Maximalists who consider Bitcoin as the one and only true cryptocurrency and Altcoins are experiments. Others think that Altcoins will eventually replace bitcoin. Just like the video tape was replaced by the CD and myspace by Facebook and old cameras with digital ones.

What are the risks of investing ICOs?

- Scammers take advantage of an unregulated industry

- Amateurs using ICO to launch projects which are doomed to failure

- Long project delivery timelines, increase the risk that competitive products will be launched before

- Exchanges need to accept the altcoin for there to be a market for the altcoin.

- An ICO can be surrounded by hype, and “pumping” to mask the cons of the ICOs and make investors invest emotionally. Later finding out it was all hot air. This is done by piggybacking on the success of Bitcoin, Ethereum and Dash without offering anything real back in return

- Regulators can change rules and make coins with certain functionality illegal in the future

- Altcoin technology is extremely new, and basic issues such as agreement on protocols are not yet established. Many altcoins will be born, and others will dissipate in the past until we eventually see the Google, Facebook and Youtube of crypto coins.

- Certain tokens can be copied (forked) and made better. The clone can eventually get more value than the original. This happens especially when the token is not an intrinsic part of the network.

See more: How to invest in Masternodes.

ICO Examples:

ETH

The price starts on the far left and shoots up to today, on the right-hand side.

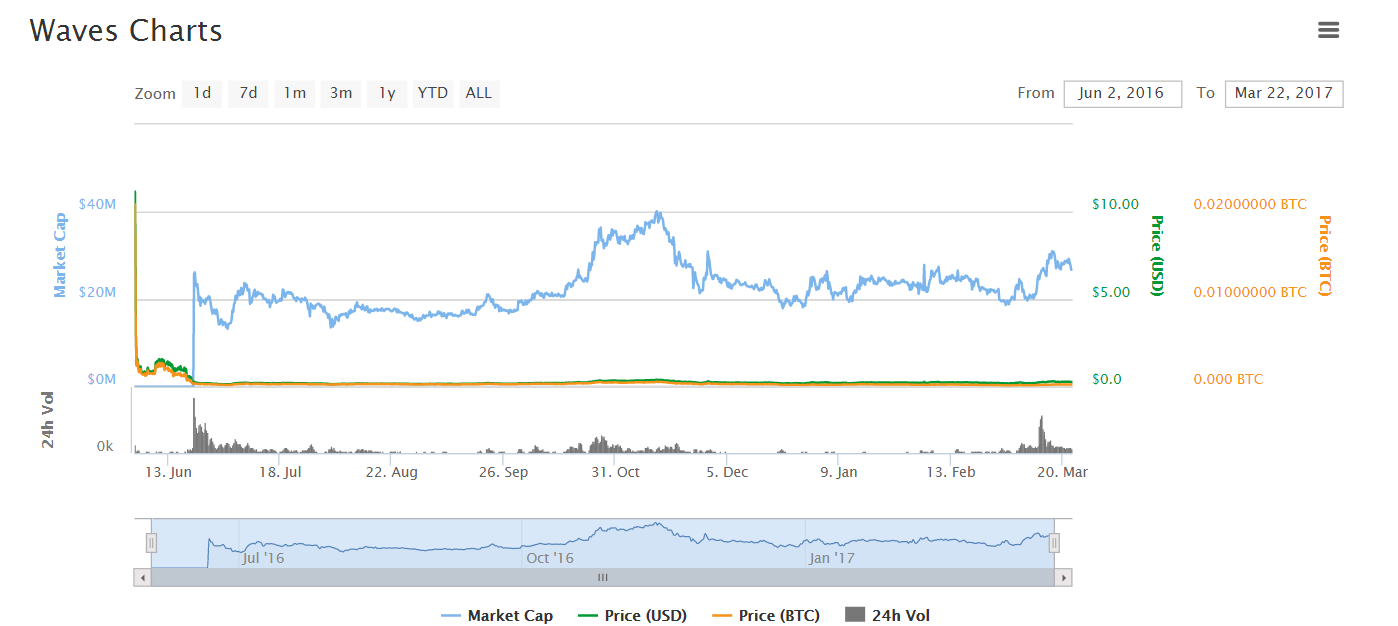

Waves

Waves have not yet recovered from the huge price drop on the left.

Where can ICO announcements be found?

The primary sources are: