Baunat diamonds are diamond dealers with showrooms in Antwerp, Paris, Geneva and Hong Kong and Mumbai. Sander Michiels is their Senior Relationship and product Development Manager, in this interview, he provides insights on the diamond market and industry.

Can you briefly introduce Baunat?

Baunat is a world leading online diamond jewellery brand. It is challenging the traditional industry by being a ‘ game changer ‘. The new business model allows us to create the most sought after diamonds at unbeatable prices.

We proudly serve the Chinese, Hong Kong and Western Europe markets. Clients can consult with BAUNAT online at any time.

Payment is accepted in EUR USD GBP and CHF, we have a selection of possible payment systems, such as Chinese CUP & Alipay.

Baunat has a rating of 9.8 on TrustPilot, what is the secret behind this success?

We believe in excelling in everything we do. We adhere to very strict quality standards when it comes to the production of our jewellery. We produce all our diamond jewellery by hand, in Antwerp, by experienced artisans and deliver very fast thanks to an efficient process. On top of this, we have a great team of passionate people following these orders and delighting customers with proactive updates about their order. Our clients feel very comfortable and at ease during the production process, this reassurance is essential because it is without exception an important purchases.

Does Baunat serve international investors?

Our website is designed to give international clients quick access to information. Our team offers support via email, phone, chat, social media, … to answer client questions quick and thoroughly. Our customer’s service delights our clients BAUNAT can purchase diamonds from a massive network of niche diamond cutters worldwide at the best possible conditions. This allows us to offer unbeatable prices to our clients. We believe in value for money, and this is clearly visible when you compare our prices to any other vendor on- or offline.

Why are diamonds expensive? Where do they get their value from?

Diamonds are a finite, natural resource with superlative physical properties and a rich history. Every diamond is a unique piece. A rare, natural gem made brilliant when it has been cut by experienced diamond cutters. It’s a combination of a valuable natural resource and excellent craftsmanship that determine the intrinsic value of a diamond. This value will rise in the coming decades. This augmentation is caused by a significant increase in demand and a decrease in supply.

What should investors look out for when buying an investment diamond?

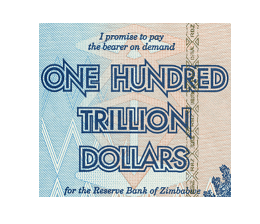

Diamonds, unlike money, are not subject to credit risks or systemic crisis. Money can lose its value because of factors not in control of the owner like interest rates and GDP. Diamonds, on the other hand, are a store of value which depend on demand and supply more than anything else. Diamonds are in demand because they are beautiful. Beautiful things are a symbol of power, elegance and status. Diamonds supply is limited, and their quality can be graded accurately, this quantifiable value creates supply/demand dynamics of scarcity. As long as there is a demand for diamonds, they will hold their value.

Giving that special someone a diamond is special because it is a unique gift from one person to another.

How should investors evaluate a diamond dealer?

Try to find the best prices; prices are easy to compare since diamonds come with a certificate, try multiple vendors. Secondly, evaluate their service level and make a choice based on their service level and price point. Personal recommendations can surely help in evaluating the level of service you can expect.

What are the key differences when considering an investment in diamonds vs an investment in precious metals?

Diamonds are unique because they have a unique combination of size, quality, shape, colour, clarity. Gold is not unique unless it is turned into jewellery. The uniqueness of diamonds gives them a special rarity value which gold cannot hold. Gold is more of a commodity because of its properties that make it divisible and non-unique, while diamonds are artefacts of value priced by investors in a different way. The beauty of diamonds matches that of art, as the craftsman of diamonds are artisans or artists turning a gem from mother earth into something beautifully unique.

Is there a difference between the preferences of the Western, Middle Eastern and the Asian diamond investor?

Asian investors love fancy coloured diamonds and when buying white diamonds prefer GIA certification and do not like fluorescence. Whereas Western investors prefer to go for commercial grade qualities of white diamond, G colour and up and VS1 clarity and up.

If an investor is considering investing a six figure sum in a diamond portfolio, should s/he buy a stone worth around 1M or invest in several stones totalling 1 M? What are the pros and cons of each of the two investment methods?

- It’s a matter of experience, available resources and liquidity.

- Rarity, quality and size will determine the value and value will rise over time. The longer you wait to sell, the higher the return.

- A commercial grade stone, value up to about 50.000 EUR / stone, has a high liquidity. They are easy to resell.

- The higher the value of the stone, the more complex it becomes to resell the stone but you can expect higher returns. It is advised to have experience and patience and proper guidance when investing in important stones. These stones have a high collectors value and because they are so limited, there is a community of very wealthy collectors that has an interest. This is where experience and patience are very important.

Can you provide some examples of investment diamonds Baunat has for sale at this time?

We source diamonds on demand of our clients. Thanks to our network we can deliver any diamonds that are available worldwide. We do have a selection of special diamonds shown here: http://www.baunatdiamonds.com/en/view-selection-of-special-diamonds but this list is not exhaustive. We recommend that clients contact us personally with their requests, this way we can look for the best/price quality currently available.

Which kind of Jewellery is both a fashionable purchase and very likely to maintain or increase its value over time? Can you provide such examples Baunat has for sale at this time?

A timeless solitaire with a high quality diamond will surely gain value over the years. We have an extensive offer of high-quality diamonds: http://www.baunatdiamonds.com/en/loose-diamonds2 you can check and compare our offer online and our team is on stand-by for assistance.

Where can potential jewellery and diamond investors find out more about your products and services Baunat has to offer both online and in your international showrooms?

Our websites baunat.com and baunatdiamonds.com offer a great amount of information, and we have a professional team of diamond and diamond jewellery advisors that can assist clients in their search.

We thank Sander Michiels for the interview.