DoFinance is a peer-to-peer lending platform that gives a great alternative to traditional financial services such as conservative bank deposits or risky stock markets to those who want to become their own financial directors. Earning up to a 12% annual return and available to private individuals in all Europe and Asia, DoFinance offers the chance to invest in diverse consumer loans in the easiest, fastest and smartest way.

How does the concept at the heart of DoFinance “Finance for human” translate in practice for the borrowers and lenders?

The platform is built as user-friendly and accessible as possible, giving equivalent opportunities to both professional investors and those who are just taking the first steps in investing. The feedback we have gathered from our current investors shows we are on the right track – majority refers to the platform as easy to use, fast and convenient.

Technically, if you have your passport or ID with you, you can register in less than 5 minutes and actually become an investor in less than a working day. We want to break the stereotype that investing is only for professional investors – with DoFinance it is available to everyone.

What parts of your the current platform are the most technologically innovative?

We have been working very hard to develop a system that would eliminate all risks for our investors. Tech savvy risk assessment tools also calculating the human factor combined with the manpower – experts on risk management in-house – is what we base our services on. Our risk assessment is built upon the team’s experience in risk management, precise calculations and predictions of human behaviour. Combined, these features allow us to analyse potential risks connected to each individual borrower, hence

Our risk assessment is built upon the team’s experience in risk management, precise calculations and predictions of human behaviour. Combined, these features allow us to analyse potential risks connected to each individual borrower, hence minimizing the risk of failure to repay the loan.

Interestingly, technologies have helped develop a smart, fast and easy to use the platform. Who would have thought that a day would come when becoming an investor will take only a couple of minutes and the investment starts earning in less than 24 hours.

DoFinance has expanded through subsidiaries in Latvia, Poland, Georgia and Indonesia. What are the advantages for investors of a platform which expands itself rather than becoming a marketplace for p2p lenders?

We deal with the entire business chain, from loans to investments. That gives us an overview of the risks involved. It is very simple – each borrower who receives a loan has been confirmed by our risk assessment team, thereof the opportunity to oversee the business processes.

DoFinance is not a marketplace, maybe we provide an opportunity to invest in fewer markets but therefore we are providing a guarantee for every investment. Hence, we can guarantee BuyBack on day 31st – we call it instant buyback guarantee.

What are the key differences between the loan types offering returns 6%, 8% and 12%?

There are three different investment plans offering 6%, 8% or 12% return. It’s simple – the conditions depend per plan.

Short-term investments, starting from 1 month, offer 6% return.

8% returns starting from month 2.

Long term investments, starting from 6 months, offer 12% return. The difference between each type is the time period of the investment and withdrawal conditions.

All investments are invested in the same type of loans and the key difference is how many times the investment will be re-investment without Auto-Invest tool.

All loan requests received by borrowers, need to be evaluated for risk, what are the most successful metrics that determine the default rate?

One would think that after developing technology and risk assessment process suitable for one country, it is easy to adapt it to another. Partially it is true, a risk matrix, as well as the knowledge on risk management, provides an advantage, however, each market has its own significant specifics.

Thus, the best risk assessment approach is a mix between external data and date provided by potential customers. Public administration institutions (e.g. credit bureaus) have external data available to companies and organisations characterising potential clients. Data provided by person itself, on the other hand, is creating the unique personal profile. Our aim is to create trustworthy and loyal client base to whom we can trust in the long term.

Why should buyers be interested in how p2p companies manage their risk exposure?

It informs on the stability of the business. Transparency in business operations allows investors to participate in the process, so to say. Understanding risk assessment process all borrowers go through provides a clearer picture of the investment process itself. After all, we all want our money to be safe, don’t we?

Our risk management gives us the chance to ensure investment risk close to zero – all loans have a BuyBack Guarantee with invested money being available right away, it is always possible to withdraw and, depending on the investment plan, receive the invested money with accumulated interest.

Can loans be extended and if do will the same interest rate apply?

We do not offer investing in loan extensions. All loans we offer to borrowers are 11-30-day loans. In case of loan extension, there is absolutely no impact on the investor as the BuyBack Guarantee switches on directly.

Does DoFinance have enough loan availability to satisfy investor demand?

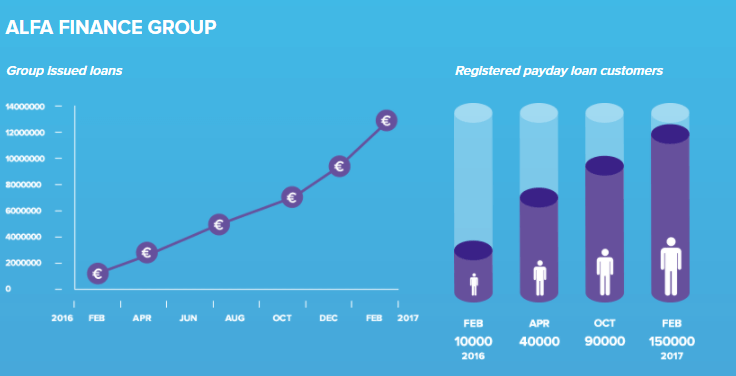

The number of investors is growing, so we continue working on possibilities to expand our investment portfolio. Our portfolio in Poland is with is the fastest growing tendency. At the same time, we are working to offer investors a chance to invest in consumer loans also in Indonesia. and other countries where our financial services will be available.

What is the average ROI for investors?

The most popular investment scheme is the one offering 12% return. Those willing to invest in shorter-term choose investment plan with 6% or 8% return. ROI we promise is exactly what the client receives. If the chosen plan says 12%, it is 12% – not 11% .

What are the advantages of the Auto-investor?

Auto Invest programme provides an opportunity for the money to work non-stop from the moment it is invested. Unlike other programs, Auto Invest ensures the investment doesn’t stand still but is constantly re-invested to guarantee the highest return possible. It is very simple. Frankly, investors’ feedback shows investing on DoFinance is so simple it almost becomes too easy. Yet, considering busy lifestyle nowadays, when the time is valued dearly, investors appreciate simplicity and speed, especially if it results in stable income.

How can investors monitor their investments?

Investors can follow their investments: all necessary information can be found on “My

investment” page on DoFinance website (www.dofinance.eu). Besides that, DoFinance will publish its financial reports annually, giving investors an insight in behind the scene. The principle of transparency and accessibility also works here – we plan to present the reports in a manner that is understandable to everyone. In other words, we want our investors to see the most important numbers without diving into never-ending charts.

Is the Buyback Guarantee bullet proof?

Our investing in risk assessment tools has brought potential risks to minimum. Moreover, our the Alfa Finance Group issue short-term consumer loans which also gives certain stability in the risk equation. Compared to long-term loans, it allows foreseeing trends much better. It is as simple – if there is a borrower who doesn’t pay back on time, we can easily prevent it from happening again. Thanks to that, we instantly see regularities, improve risk tools and score cards, therefore minimizing potential risks.

How long does it take for the buyback guarantee to kick in?

BuyBack Guarantee is working immediately. For example, the loan is given for 30 days: in case of loan extension, we buy it back instantly – on the 31st day. Actually, the investor might not even notice buyback guarantee kicking in as it happens the same moment loan is extended and continues reinvesting the money right away. DoFinance offers instant buyback guarantee, and if necessary we are buying back on the 31st day and reinvesting. The client itself is not feeling as we are buying back and reinvesting further exactly that second.

How is the BuyBack Guarantee financed?

Currently, we offer to invest in Polish consumer loans, and buyback is provided by Alfa Finance Group Polish affiliate which is loan originator. Guarantee is provided within risk management system but the priority for us is to ensure that all loans are repaid on time.

Buyback guarantee provides effective portfolio administration: analytic work on minimizing loan default rate, work with the difficult clients, systematic and continuous learning and development on risk assessment at the organisational level. The result is a low default rate, which ensures 100% Buyback guarantee.

What is it that excites you most about the future of DoFinance?

Co-founder doFinance

We are excited to provide financial technologies from people to people. By proudly breaking the stereotype that investing is only for professionals, we offer anyone to become his or her financial director. Can be a life-changing opportunity for investment as no other platform is build to ensure such am easy, fast and smart investment opportunity.

Besides that, we are happy about our growth – recently we opened European investment gates to Asia, and now also Asian investors can invest on DoFinance. Frankly, the most exciting is yet to come as we don’t plan to stop where we are. We are exploring new markets, and we plan to go beyond geographical limitations. Nonetheless, our most important task is to continue working to satisfy our existing investors.

Where can investors follow information about DoFinance?

You can find DoFinance on Facebook (https://www.facebook.com/DoFinance-1030896163713478/), where we gladly share the newest updates as well as more information on the team. We appreciate your questions, comments, feedback, so you can also reach out to each one of us personally. The contact details of the team can be found on our web (https://www.dofinance.eu/en/about-us). Moreover, website’s news and media page is up and all latest developments of DoFinance are available there.

Reader Comments:

- Do you invest with doFinance? What was your experience?

- In your opinion, what are the pros and cons of p2p lending today?

- Do you know of other p2p companies you would like me to feature on this blog?