Buy to let investments are notoriously time-consuming because of tenants, taxes and teething problems such as plumbing electrical faults and squeaking doors.

Holiday lets and short term letting are even more cumbersome than long-term lets. Short term tenants cause more wear and tear to the property and require more time to manage. Short term lets tend to have higher vacancy rates if not priced correctly and located in prime rental areas. On the other hand, short-term lets can command higher rental rates, than longer lets.

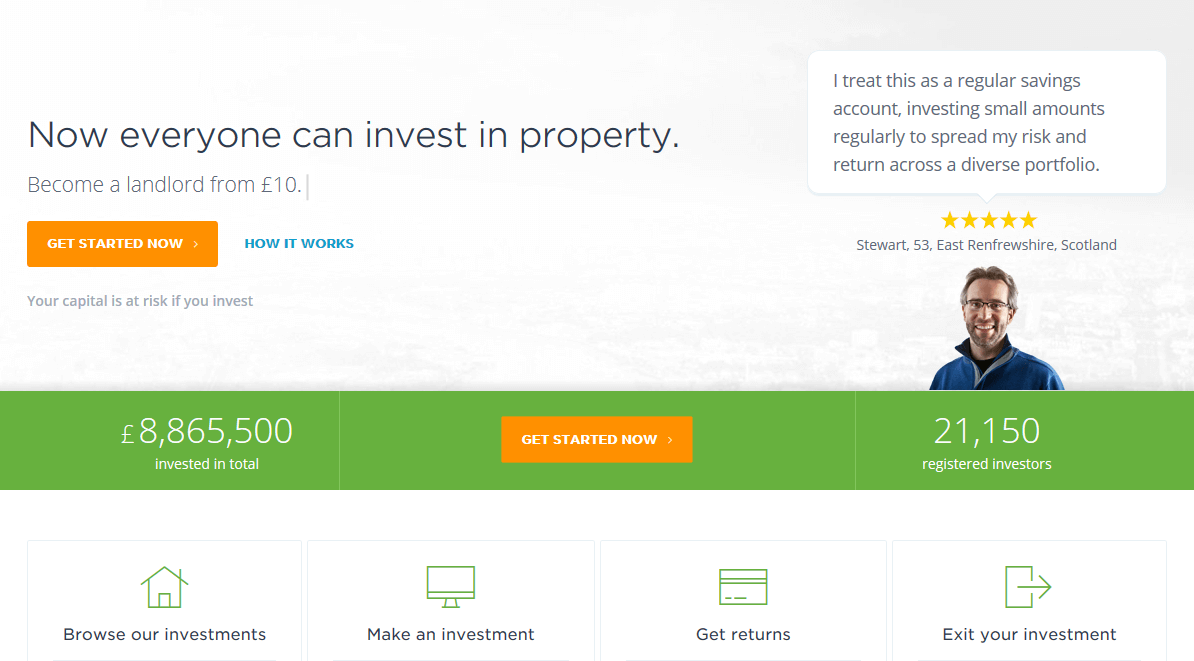

Holiday crowd is here to solve all of the above problems and leverage the opportunities! Their business model is one of the new innovations in Property Technology or Proptech. This model leverages the power of the crowd by coordinating the co-investing of a group of investors in one single property.

Co-investment happens when investors pool funds to invest. Holiday crowd coordinates the investors and manages the property. Without HolidayCrowd this process would be practically impossible.

Co-investment properties are managed through a dedicated SPV (Special purpose vehicle) which is managed by HolidayCrowd and various subcontractors.

With the actual Brexit on the horizon and the falling pound, Britons will probably be more inclined to go on holiday to the many beautiful spots the British Isles. In addition, the lower pound makes it easier for visitors to enjoy Britain, in fact, it is estimated that 38.1 million visitors will visit Bbritain in 2017.

Holiday Crowd is partnering with Sykes Cottages one of the largest holiday letting agencies, their experience and expertise will enable Holiday crowd to source properties in the UK’s top tourist spots.

Review of Holiday Crowd with Alistair Malins

CEO of Holiday Crowd

What is the average ROI expected?

ROI will vary depending on each property. However, we have just crunched some data in conjunction with our partners, Sykes Cottages, which shows how the holiday property market remains resilient at a time when the residential Buy-to-Let market is suffering in many areas.

The data shows 4.9% increase in average holiday booking values year to date in 2017 against the prior period in 2016, compared to the residential Buy-to-Let sector, which according to recent data from Landbay rents are rising at a 12-month average of just 1% in England and Wales.

What is the average number of properties you plan to list in the first year?

We are in the process of funding six properties currently and would expect this number to be considerably higher in 12 months time. We have ambitious plans for this market and intend to fund over 100 properties in the UK in the next couple of years.

Which geographic areas will HC concentrate upon?

We will initially focus on UK properties in desirable tourist locations which we believe will other the greatest rental yield and where house prices remain robust. We also use a vast amount of data generated from bookings, combined with property price data to ensure we are targeting the best areas and types of properties for investment.

What is the fee structure for investors?

We charge a 5.0% one-off fee on any initial investment amount for sourcing the property and arranging the transaction. In addition, we charge 5.0% of gross rental income per annum to cover all ongoing management costs and expenses that you describe.

Will the sink fund be used on each SPV or for all the properties?

Investors invest in a specific property. Investment is made via a company

specifically set up for the transaction, called a Special Purpose Vehicle (or SPV). The SPV owns the holiday property outright and investors own a beneficial interest in the property via shares issued in the SPV proportionate to the value of their investment.

Can rental income be stored on an online wallet?

Right now, funds are transferred into the investors own account. An e-wallet feature is in development but is not yet available for investors. Once this is live, we intend to let dividends be reinvested in properties to allow investors to compound their returns.

Visit Holiday Crowd to learn more about their investment offerings.

We thank Alistar Malins for the interview.