Grant Payton is the National sales manager of MyFarm. This firms offers investing opportunities in dairy farms, vineyards, and beef farms. In this interview, Mr Payton explains how investors can investing in New Zealand farms through MyFarm.

Farm syndicate investing in

New Zealand farms

Can you briefly describe Myfarm.co.nz?

MyFarm is a farm syndication business allowing people to own a stake of an agricultural or horticultural business. We currently have over $550m (NZD) of assets under management on behalf of approximately 300 investors.

How does Myfarm.co.nz sustain itself?

MyFarm earns fees through the establishment of new farm investment businesses and through ongoing management fees to oversee the business on behalf of investors.

Myfarm.co.nz has been operating since 1990 how has technology changed the way you farm?

Farming technology has allowed increased efficiency on farms through the likes of labour saving technology and improved monitoring and recording of stock and produce. Much of this has reduced the ‘human error’ factor and allowed improved reporting to all stakeholders and managers of the business.

We have also seen a dramatic increase in the use of water saving technology and recording devices to improve water and wastewater efficiencies on the farms.

What are the main benefits when investing in New Zealand farms as compared to farms in other countries?

Expertise and cluster effect. Being a small country and targeting where we select our investment properties to be in sectors clustered around certain regions eg Vineyard investments in Marlborough and dairy investments in Canterbury or Southland, we are able to draw on the expertise and skill sets of staff and service companies linked to these sectors. This provides for competition between service providers creating efficiencies that flow through to the businesses we operate on behalf of investors. It also allows for greater choice when selecting the on-farm managers and staff.

Who is the primary consumer market of products from your farms under management?

All our farms supply major producers such as Fonterra for dairy and Zespri for kiwifruit. These producers and marketing companies hold the expertise to process the products we produce, market and sell to the end user creating greater downstream value than we could manage on our own through our individual businesses.

Who is the typical investor in myfarm.co.nz?

This varies and is a cross section of the community. A typical syndicated property would consist of professionals, farmers and the general populace.

What is the minimum investment?

A typical investment would have a minimum investment of $100k.

What are there restrictions as to which investors can invest?

All investors must meet wholesale or eligible investor requirements. There are no restrictions on where people can invest from but most syndicates would have a restriction on the level of international investment (up to 25% can be foreign owned without requiring Overseas Investment Office approval).

What is the main business model for investors, dividend income through the life of the investment or capital gains on exit?

Both. We aim to set our investment businesses up with a conservative level of debt (30-40% LVR) to help drive cash returns to investors and choose both property with the ability to generate capital growth over the life of the investment. The success of this varies according to the timing it is purchased and the timing it is sold. Other factors such as development margins can also influence the capital gains generated.Is there

Examples of investments on http://myfarm.co.nz/

Is a secondary market?

Yes. Through MyFarm and our database as well as www.syndex.exchange

What are the initial and periodic fees that investors will be responsible for?

Initial fees are typically 3.5% of the total asset value at the establishment. Ongoing management fees vary form an hourly rate to a set fees of say 0.35% of asset value.

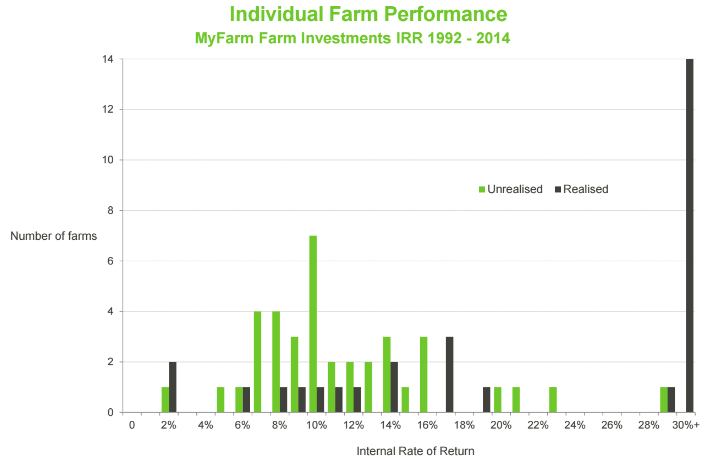

What has been the average return to MyFarm.co.nz clients?

How are the individual farms managed on a day to day basis? How are they audited?

On a day to day basis they are managed by a farm manager in the instance of a dairy farm. A kiwifruit orchard or vineyard will managed by a contract manager who coordinates contractors to carry out the seasonal requirements for the operation of the business.

How is each farm investment structured?

What will investors own? (Land, Shares of a special purpose vehicle or something else) Investors own all the assets (land, stock, shares, machinery) and are structured as a limited partnership. This structure allows investors to manage their own tax affairs.

What are the key criteria investors should consider when investing in farms?

Location, quality of asset and debt. You should look for an asset with the ability to have alternative land use in the event of a sector disaster, or be located close to a town or city which is growing. Quality of asset relates to the quality of the infrastructure and soils. Good infrastructure and soils provide greater certainty of operating performance and less chance of surprises (eg R&M).

While a level of debt helps to drive returns and ensure you money is working harder for you, too much and the business is more vulnerable to productivity shifts (loss of productivity reducing income to meet debt requirements) or changes in the interest rate cycle.

How can potential investors learn more about MyFarm.co.nz Investors?

Contact details:

Grant Payton

National sales manager

grantp@myfarm.co.nz

029 445 5871

Visit their website: MyFarm.co.nz

Is there anything else you would like the readers of InvestItIn.com to know?

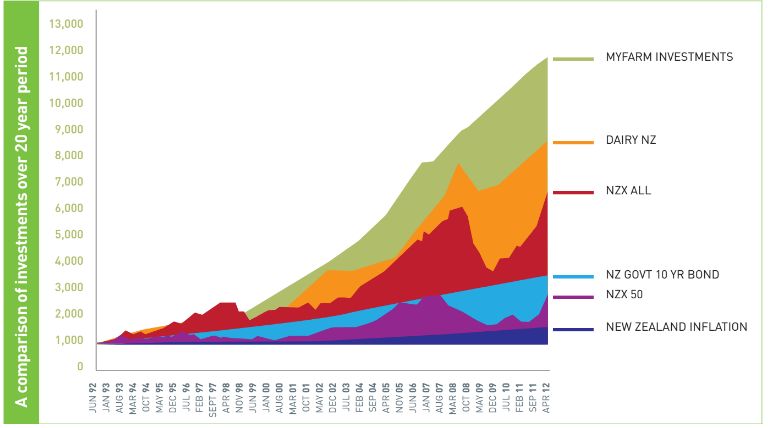

MyFarm offers an excellent opportunity to diversify an investment portfolio with an experienced and capable farm investment company. We have been operating in this sector for over 25 years and have excellent networks and knowledge to offset the pitfalls that can plague private equity partnerships. Hard assets such as NZ farmland have also proven over time to beat inflation and be one of the safest places to invest and create wealth.

We thank Grant Payton for the interview.