Reggie Middleton will cut through the banking middleman for certain financial services by creating a software powered by the Veritaseum token. This software will be the gateway to execute financial transactions without the need for stockbrokers and bankers.

What is the business model of Veritaseum?

Who is the target market?

What is the value that Veritaseum brings to the market?

Profiting from disintermediation of high friction industries through cost shifting.

Make the stuff that greedy businesses charge too much for so cheap that everyone will have to buy from us. We’ll accomplish this by dissecting and rebuilding the business models of greedy companies in a way that earn revenues from related, but not directly connect services/products that subsidise our cutting the main service/product margins down to zero, if not lower.

A perfect example of a company that has excelled at cost shifting is Google. They use their search engine ad revenues to subsidise their entry into all types of disparate markets, wreaking havoc along the way. They have wreaked the media and news industry by making their most profitable product free.They’ve redefined the mobile industry by making the largest R&D cost in the business an actual revenue stream if not free (ask Nokia and Blackberry, and soon Apple as well. They disrupted GPS devices (industry leader Garman, with maps), Office productivity (tell Microsoft), cloud computing and storage, email, and the list goes on.

Google is the Google of information on the Internet. We are the Google of Value exchange, everywhere.

Our primary product line is creating the entranceway to the global peer-to-peer capital markets. Thus our target market is those who use capital, ie. everyone. This may seem pie in the sky-ish to some, but think about gaining the keys to the internet in 1993. If you were to do that successfully, who would your target market have been? Voila! Instant understanding!

The value-add? Veritaseum brings dramatically lower costs for transactions of value while simultaneously offering superior service. Like Google’s free offerings that were often better than what you actually paid for due to their network effect and the powers of the crowd), we offer access to assets (like asset managers) and value trading (like brokers), without counterparty risks, credit risks or balance sheet exposure. We do all of this at near zero margin, meaning that competitors should expect to run at zero profit to compete with us. These reduced margins mean dramatically lower costs to the consumers of these products, consumers that are accustomed to paying exorbitant prices now get the “gmail” effect. Think synthetic, software-driven vehicles that compete directly with hedge funds at just 10% of the costs or near free trading tools that eliminate the need for a broker.

What is the history of Veritaseum?

Veritaseum was conceived in 2013, and a prototype of our value trading platform was up and running by the end of that year – the first capital markets implementation of smart contracts and blockchain technology of its kind. We believe we are also the first to file for patent protection of the same. The platform allows you to trade the value of almost any listed financial asset, about 25,000 tickets, all without a broker, bank or exchange – or risk of someone not paying you.

What software development has been done on Veritaseum?

When will the final product be launched?

We have about 10,000 lines of code in the beta product, which has been running live on the bitcoin blockchain for years now. It was pulled from public access when the CFTC claimed regulatory authority over bitcoin causing potential compliance issues with esoteric rules. As we port the app over to Ethereum, we will be coding and engineering our way around those snafus. Expect a stable product no later than 2018.

We are also creating smart contract-driven synthetic digital asset managers that aim to best the exposures and performance attempted by hedge funds, but at zero margin.This means up to 90% less than what consumers are now accustomed to paying. This also means that the digital asset pool (the financial machine) can underperform a hedge fund manager by 90% and still make more money for those who participate. Since these pools will be powered by our world renown research and the strong returns of today’s digital assets, there’s a quite the chance these machines will outperform before fees as well.

We will make our money by selling the machine research. The machine has no human fund manager or asset manager, hence there’s no such thing as 2 and 20. The machine just pays fees for research and the services needed to stay in existence and its sole purpose in life is to make money for the Veritas token holders that sent tokens to it without charging them. It’s mandate is to maximize the value of its token pool, not maximize its bonus pool or AUM fees. It’s all really quite cool!

You can expect an alpha version of this within 30 to 60 days. Yes! That soon!

There you go. In a nutshell.

Will there be a dedicated wallet/ platform for Veritaseum, where this functionality can be executed in a user-friendly way?

The interface will be done in HTML5, and will be easy enough for my 11 year old daughter to use. Granted, she’s smarter than a third of the traders that I know, but she still makes a good litmus test. 🙂

How many software developers work on the development? Do you have/Will there be a business development team in the future?

Thus far, five developers, engineers and analysts (we are much more than a technology firm), but we plan to scale up some after the token offering .

Actually, we are looking for biz dev, marketing and salespeople now. Hopefully we’ll have a team together before the first product hits mid-beta.

What are the main objectives of Veritaserum for 2017? How will your strategy develop in the next 5 years?

Our goal for 2017 is to convince the buy side institutions of global finance that:

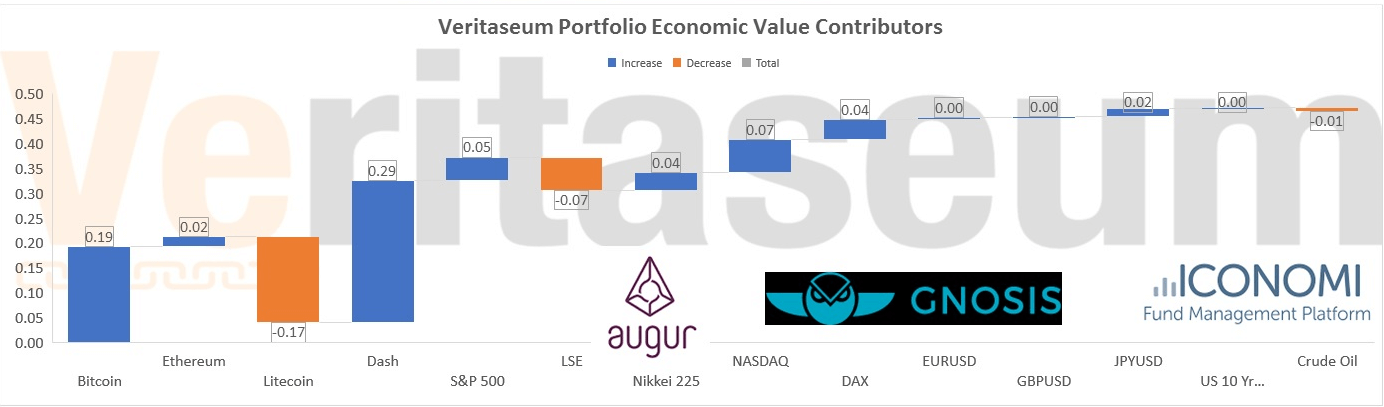

This is a legitimate and exciting new asset class, which it is (reference chart below), and;

Veritaseum’s Autonomous Financial Machines are the best, least risky way to gain exposure to this new exciting asset class.

Will Veritaseum be financed only from the ICO, what will be the source of funding for developments in the future?

Time will tell. The ICO is good for working capital, but if things go as we plan, we should be able to self-fund through cash flow. Now, that’s a though… A blockchain startup making real money! If we can’t scale fast enough to match our growth, we may go back to the ICO market with a fantastic story to tell of how we have opened more doors to opportunity than we have cash to walk through…

What are the technical features of the Veritaseum token?

The token allows users to redeem directly back to Veritaseum for financial advisory services and research. This is available immediately.

It is also able to be fiat-locked, in order to power vehicles that need characteristics of fiat currency exposures such as USD, EUR or RMB.

Another use is as a key to enter the autonomous financial machines that we discussed earlier, the P2P value trading system and our upcoming products such as the P2P letters of credit.

To find out more about Veritaseum please visit: http://veritas.veritaseum.com/

We thank Reggie Middleton for the interview.

I welcome all to learn more about what we are doing through this tear sheet, the purchase instructions and the following informative videos:

Deep Dive into Veritaseum P2P Capital Markets: Pt 1, the Basics

Deep Dive into Veritaseum P2P Capital Markets: Pt 2, Rise of the Financial Machines

Deep Dive into Veritaseum P2P Capital Markets: Pt 3, Wall Street’s Skynet!