Minto p2p loan investing for newbies.

Mintos is a peer to peer platform based in Riga. Mintos is not a bank, but it can legally provide loans to borrowers. Investors can also participate in these loans. This participation is known as crowdfunding, whereby each investor buys a small part of a loan.

The best way to learn about Mintos is to read the Mintos FAQ.

Disclaimer: This mini guide for Mintos newbies, will not protect your p2p investments in any way shape or form. When using this guide all risks related to investing in Mintos will still be present. In this article, I am informing you of what I did. This should be taken as investing advice of any sort. Investing is a personal choice and the risk you bear when doing so, is also personal!

OK… enough with the small print.

What are you buying when you buy a loan part on Mintos?

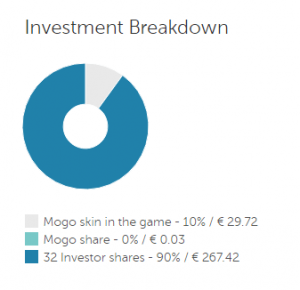

A loan on Mintos are divided into many slices, you can buy a slice of a loan. The example below shows how a car loan was divided between Mogo the loan originator and another 32 investors.

There are fourteen lenders which list their loans on the Mintos platform, and more are being added frequently. Each lender has a different profile, meaning they issue different types of loans with different risk profiles and different rates of return.

This is a list of the Lenders as of February 2017

· ITF Group

· Aventus Group

· Creditstar

· AgroCredit

· Lendo

· Kredito garanta

· ACEMA

· Aforti Finance

· Banknote

· Creamfinance

· Debifo

· Hipocredit

· MANO UNIJA

· Mogo

Important terms to know before you start investing on Mintos:

- Loan Originator: The company providing the loans

- Loan Term: The length of the loan. how many months or years the capital will be tied up.

- Interest Rate: The rate of return on a loan.

- LTV: Loan to value, the total value of the assets, in relation to the loan amount being lent.

- BuyBack Guarantee: A system whereby the loan originator guarantees* the loan in case of default

- Primary Market: Loans listed by the loan originators

- Secondary Market: Loans on sale by investors who bought the loans from loan originators and now are re-selling them to other investors

- Portfolio Size: The total amount an auto investor is allowed to invest.

Read also: Full List of terms used on Mintos, Assignment Agreement

Unofficial Checklist for Mintos newbies.

Some of these steps are explained in more detail below.

- Do not invest money you can afford to loose

- Register on Mintos

- Explore and understand the Mintos platform

- Explore the statistics

- Make a deposit (Careful, do not invest all your money in one go!)

- Make a withdrawal (Do this to test that you can both deposit and withdraw)

- Make one test loan manually

- Understand your investment. How long is it for? What is the risk profile?

- Make some more test loans

- Understand your investments. Investigate, leave no stone unturned

- Test the auto investor with a small portfolio size.

- Review your investments purchased by the auto-investor

- Increase your portfolio size slowly

- Create new Auto investors according to your needs

You can find the Official Get Started list for Mintos here: Mintos First Steps

Have a browse on the primary market:

Click on the loans listed on the primary market, understand the type of loans on offer. You need to understand the key differences in each type of loan listed. This is essential before you can start investing. Check what is under the hood.

When you are loan shopping have these questions in mind:

- How long will the funds be tied up for?

- What is the rate of return?

- What is the risk of default?

- What kind of guarantee and what are the strings attached to that guarantee?

Many loans never become visible in the primary market as the auto investment settings of the investors will buy these loans before they become available on the primary market.

Your first investment on Mintos

When I tested the Mintos investment platform, it worked fine, however since you are still a newbie there are additional risks. On my first day learning about Mintos, I did not invest all my deposit at ounce. Instead, I browsed the primary market and learned about the choice of loans available. Then I dipped my little toe gently. Some loans have a loan term of more than 60 months, investing in these means that your money is locked for 60 months! You could sell them on the secondary market, but there is no guarantee that they will sell at the price yuo want.

In the beginning, I wanted to make sure I understood well what I was doing. So I took it slow, just like I would on a first date 🙂

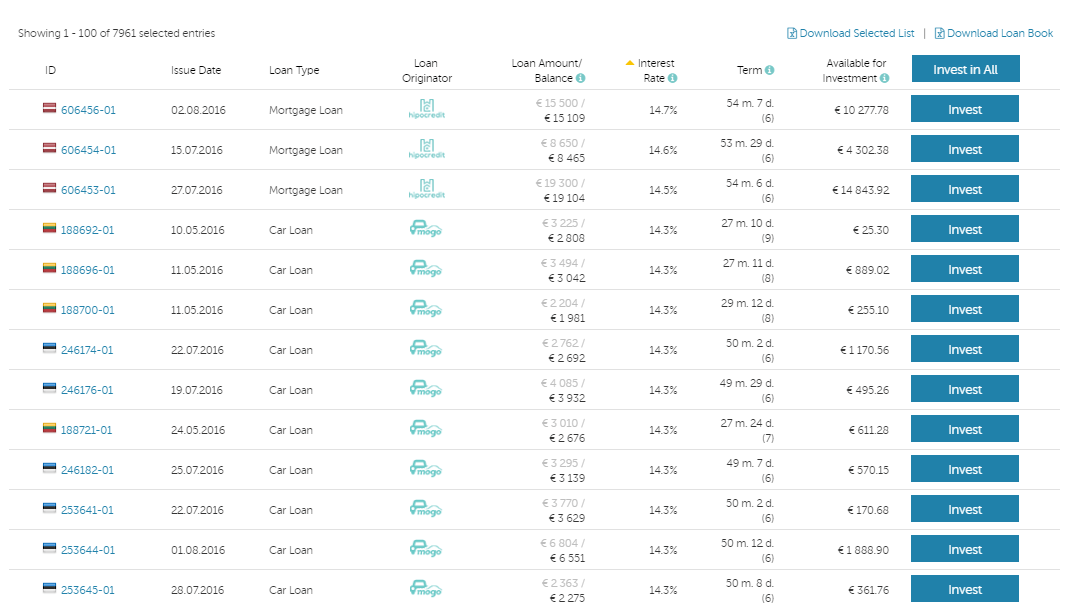

Mintos Loan Listings

Examples of loans listed on the primary market.

When I felt confident that I could distinguish between different types of loans, loan originators, LTV rates I started experimenting with the auto investor tool.

Graduating to the auto investor

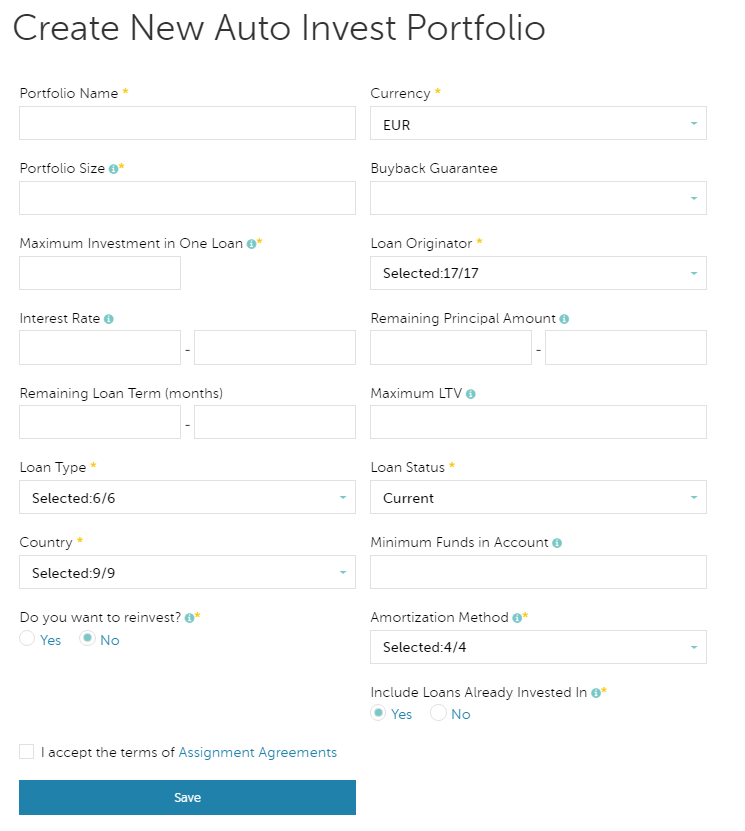

Investors can buy loans automatically through the Mintos Auto investor. This can be a system of mass efficiency or otherwise. Powerful tools can be used either way. The Auto investor is a tool which finds loans according and then invests in then invests in them automatically, up to the Portfolio Size you specify.

When I was learning how to use the auto investors I set the maximum investment in one loan to the minimum: 10 Euros and set the Portfolio size to 30 Euros. This meant that I would buy three loans with this auto investor. I activated the auto investor and then checked which loans the auto investor was buying.

Sometimes, the auto investor will not work immediately as loans of a particular type can take some time (multiple days sometimes) to be listed by the loan originators. The time I invested in waiting and learning was time well invested.

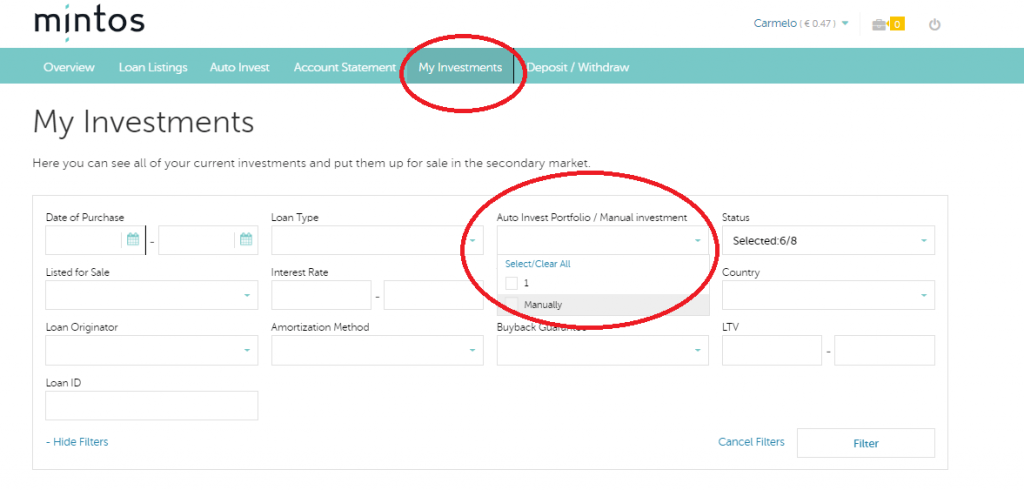

Check your Investment

This step was critical for me to make sure I was investing in the loans I intended to invest in.

I followed the two circles above to have a list of which loans the auto investor bought. Then I made sure that I understood well what I was buying and that the auto investor worked as I thought it would.

There is much demand for some of the loans, and in fact, some lenders have been lowering their interest rates. Because of this demand, requests for certain kind of loans will be in a queue and it might take anywhere from one minute to a few days to reach the top of the line.

If the auto investor does not immediately buy any loans, leave it running and come back in a couple of days to analyse the results.

If you made have done all the steps above, congrats! You are well on your way to learn how to invest on Mintos. There is much more to learn but you have come closer to mastering the basics.