Žltý melón is a p2p platform from Slovakia which offers many opportunities to both investors and borrowers. Through this platform investors can finance several types of loans. Different loans on the platform have different risk profiles which investors can use to set their own interest rates. Žltý melón has provided very comprehensive answers to a series of questions from InvestItIn.com. I highly recommend reading through this interview, as it provides key insights on what they offer to investors, as well as how to evaluate the pros and cons of any p2p platform.

Žltý melón has provided very comprehensive answers to a series of questions from InvestItIn.com. I highly recommend reading through this interview, as it provides key insights on the platform in addition to tips on how to evaluate the pros and cons of other p2p platforms.

What is the meaning of your company name: Žltý melón?

Translated to English it literally means ‘Yellow Melon’, or cantaloupe, however there are also

several subtleties to the name.

Firstly, melon is a slang term for money in Czech and Slovak. But more broadly the name was

chosen because we are trying to bring a ‘fresh’ approach to p2p lending in stark contrast to the less user-friendly ‘bank’ type images and messages used by other major p2p platforms.

Also, when people typically think of a melon they think of a watermelon, yet in fact the

cantaloupe is much sweeter, despite being smaller and often overlooked. Similarly, we believe

we offer investors a ‘juicer’, ‘sweeter’ deal than they can get with other more well known lending platforms.

What are the core advantages for the investors on Žltý melón over the banks?

By their very nature, all p2p lending platforms share several key advantages over borrowing and saving/investing with mainstream banks in the traditional sense. Specifically those advantages arise from the core principles of p2p lending that allow investors to cut out the middleman by using p2p lending platforms, which are leaner and have fewer operational costs that banks ultimately pass on to investors.

We would typically point to three such advantages p2p lending platforms, like Žltý melón, have over banks:

1. Higher returns on investment: This is inherent in the p2p lending model, which cuts out

the unnecessary middleman (banks) and passes on the savings to investors that result

from leaner operational structures and different business models.

2. Control and transparency: Investors choose who and what to invest in, when and where

they want to invest, and have much greater control over their money in general. By

definition p2p lending is more transparent than mainstream financial institutions and the

model balances investments with lending in a way that will helps prevent global financial

crises in the future.

3. Fairer finance: Again, by definition p2p lending offers both investors and borrowers a

‘fairer’ deal because it puts people in control rather than large financial institutions and

their shareholders. The vast majority of the profits that result from the financial activity

of borrowing and lending stays with the investors (ordinary people) that fund it, rather

than with the banking institutions that merely facilitate it.

We would also highlight several distinct advantages Žltý melón offers investors over other p2p

lending platforms:

1. A ‘juicy’ deal: The average returns for our investors since we started operation in 2012 is

8%, after accounting for fees and loan defaults, which is well in excess of the top

headline rates advertised by other p2p lenders. What is important here is that this is not

just an advertised headline rate, but a real average figure that our investors can expect to

earn, which takes into account the stability and minimal risks associated with investing on

our platform.

2. Pure and simple: Unlike other p2p lenders, especially those in the UK, we have no

interest in becoming a bank and therefore pride ourselves on offering the purest form of

direct p2p investing based on an open market for loan auctions. However, we have also

implemented many features like our proprietary auto-invest tool to ensure that using our

platform is as simple as possible and easily accessible for both experienced and novice

investors.

3. Refreshing: Our focus on doing the little things right is important because it allows us to

be innovative and push the envelope with regards to the types of products and services

p2p lending platforms offer to investors. Our range of Cash-Free investment

opportunities are truly innovative as they offer investors both the high rewards of p2p

lending without the associated risks typically faced by investors on other p2p lending

platforms. All of this is without having investors pay in to any sort of ‘provision fund’,

which ultimately decreases the profits earned by investors and is a clear indication that

p2p lending platforms are moving to become more like the banks they initially sought to

replace.

You apply a fee structure which is different from most other platforms. What are the advantages of this fee schedule for the investor?

Our fee structure has two key advantages over those used by banks and other p2p lending

platforms.

1. It is entirely transparent: For us this is not just a marketing phrase, but something we

have embedded into everything we do. All of the fees that both borrowers and investors

will ever pay are clearly listed and are simple. This means that investors can easily

calculate exactly what their expected returns will be after paying all of the fees

associated with using our platform.

2. We only make money when investors do: Because the main fee paid by investors is

linked to the repayments on the loans they invest in, they can always trust that we will act

in their best interest. Specifically, that we will do everything in our power to minimise

loan defaults and verify the credit worthiness of borrowers on our platform. If people

don’t make money from investing on our platform, then we don’t make money either, and

that’s how we think it should be.

How are the demand and supply dynamics for the lenders and borrowers on your platform, and how does this vary across different geographies and loan types?

We have worked hard over the past four years to ensure that we grow quickly, but also in a

balanced manner than ensures we increase both the demand for loans and the availability of

investment funds at a steady equal rate.

To give you an indication of our success in this area, at present over 90% of successful loan

applications on our platform are fully funded within the loan auction period. We are very proud of this result as it shows that there is clearly sufficient investor funding available to borrowers.

However, more importantly this also shows that investors are not being forced into investing in every loan auction that becomes available, just in order to generate returns from their

investment.

What is the reason you refer to real estate developer loans as cash free loans?

Our line of Cash-Free loans are a particularly innovative type of p2p loan that to our knowledge is not being done by any other lending platform. The Cash-Free housing and Cash-Free parking loans are linked to the purchase of newly developed pieces of real estate (new homes and parking spaces/storage cellars respectively) which require buyers to put up a significant deposit and reservation fee at the first stage of their purchase.

Our Cash-Free loans provide the funding for buyers to pay these reservation fees to secure their new home or storage cellar. These fees and the associated loan can eventually be refinanced or roll-into their bigger long-term mortgage loan at a later date, when they complete the purchase of the property.

In a nutshell, these loans remove the ‘cash’ barrier that can prevent people from purchasing their new home, especially for young first time home buyers. Similarly, we also offer Cash-Free loans for the purchase of large high value consumer goods, like a specialised custom bicycle, which allow consumers to finance the purchase over a series of instalments. Essentially, in all three cases, our Cash-Free loans make these large purchases ‘free from cash’.

Currently, there are three special offers on Žltý melón: Affiliate earning, Czech loans with bonus and Cash free loan amounts. Can you give us an indication for how long these offers will be available? Do you plan to have other special offers in the future?

We always want to provide investors with the best possible opportunities to earn money by

investing on our platform and being involved in growing our community. For this reason I can

definitely say that our Affiliate programme, which rewards investors for recommending Žltý

melón to their friends and colleagues, is here to stay and we hope that we can make it even more lucrative for investors in the future. Similarly, we will definitely be having a variety of other special offers for investors and borrowers in the future. For instance we have actually just completed our annual New Years competition, where users could win up to 1,000 Euro simply by recommending us to their friends and family over the holidays.

Similarly, we will definitely be having a variety of other special offers for investors and borrowers in the future. For instance we have actually just completed our annual New Years competition, where users could win up to 1,000 Euro simply by recommending us to their friends and family over the holidays.

In terms of the bonus offers for investors that invest in Czech loans and Cash-Free loans, we have been extremely happy with the response we have gotten from investors for these promotions and so hope to keep them going for quite some time. Unfortunately, we don’t have any fixed plans at present that we can share, so I can only recommend that your readers take advantage of these deals while they are still available!

Do you notice any trends in your secondary market? – Do you have any tips and advice for investors buying loans on the secondary market?

Our secondary market is a great example of our commitment to providing a ‘pure and simple’

form of p2p lending for our investors. It provides investors huge flexibility and control in terms of reselling their investment in loans and realising their investment early, while also giving investors the opportunity to earn even greater returns by buying such investments at a discount on the secondary market. In terms of current trends I can say that our secondary market is extremely active and there are a wide range of opportunities available for investors that want to buy or sell existing investments.

My biggest tip for investors looking to buy investments on the secondary market would be to

take full advantage of our range of automated investment and notifications features that make it easy to stay up to date and take advantage of new opportunities on the secondary market. For investors looking to sell investments, I think the key point is to make sure that the investment is priced aggressively in comparison with the other offers available so that it is as attractive as possible for buyers and will be resold quickly.

How are interest rates set on Žltý melón ?

Žltý melón has built a ‘pure’ model of p2p lending, individual investors are allowed to set their own interest rate for each loan. There are however some maximum/minimum thresholds related to our recommended interest rate for that risk category of borrower.

The interest rate for the entire loan, paid by the borrower, is then calculated as one rate based on an amalgamation of these individual interest rates for each component part of the loan funding. In this way, investors have more control over their risk/returns than on other platforms. Achieving this is not easy and a key innovation of ours. As obviously, investors earn slightly different returns each month from their investment (this occurs each month when a borrower makes their fixed-sum scheduled repayments, which is made as one repayment from the borrower’s perspective, but is then divided/distributed as appropriate amongst all the investors in ‘real-time’ by our system)

Are you satisfied with the default and recovery rates on your platform, how do these vary across each of the loan types?

Our ability to screen loan applications and control the risks for investors is one of the things that we think clearly differentiates us from other p2p lending platforms. Investors on our platform are able to earn much higher returns than with traditional banks, or even other p2p lending platforms, but not because they have to take on equally high levels of risk. This is why we feel we offer the best deal for investors. Not in terms of the highest possible profits or the absolute security offered by banks, but in the the best possible combination of high returns and minimal risks.

Similarly, as part of our commitment to offer investors a ‘pure’ form of p2p lending, we do not

require investors to pay in to a bank-style ‘provision fund’ or ‘guarantee fund’. Such schemes

ultimately decrease the returns earned by investors and run against the principles of p2p

lending. Instead we provide investors with high levels of security for their investment through

other means.

This starts with our proprietary risk assessment and verification processes that we use to screen loan applicants. We assign a risk category for each borrower, which investors can easily use to decide whether or not to invest and what interest rate to charge a particular borrower. Secondly, we have established a not-for-profit organisation, ZOPI, that handles all of our debt-collection and recovery procedures – up through legal enforcement of a defaulted loan. These services are offered to all of our investors free of charge and are extremely effective.

At present we have been able to recover around 30% of the defaulted loan principle, for loans

where legal enforcement was necessary. It should also be noted here that this figure will

increase further, as for many loans the process of collection is still ongoing because legal

enforcement is, by definition, a somewhat slow process.

However, legal recovery and enforcement procedures are of course a last resort. We work hard to get borrowers back on track should they fall behind on their loan repayments, which we have been particularly successful in.

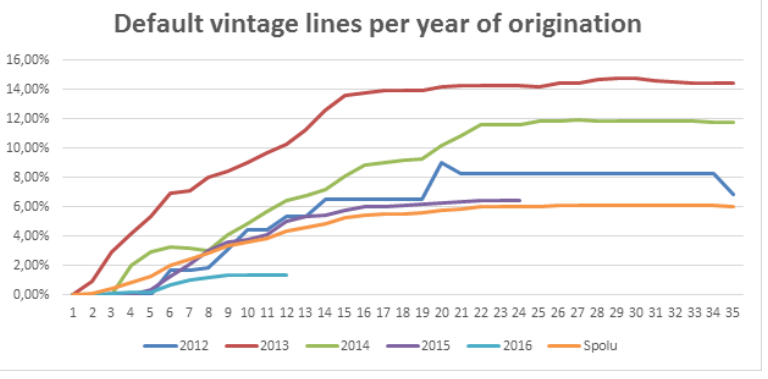

Overall, our default rates for loans issued in 2016 currently stands at just 1.32%, which continues our trend of decreasing default rates year on year since 2013. (The default rate for loans issued in 2015 is currently 6.49% after 24 months) Again, this is something we are immensely proud of and is what gives our investors the confidence to use our platform.

Perhaps most importantly though is that we publish all of our information on the performance of loans on our platform, including the impact on investor earnings and breakdowns of loan performance by region and loan type on our website for the media, our investors and your readers to see. (I have included one such graph from our website below for you to see the year on year decreasing trends of our loan default rates (Note: ‘spolu’ means ‘in total’)

Currently, you offer a buyback guarantee on Realestate or Cashfree loans, do you think that this will be extended to the other loan types? In your opinion what are the pros and cons of a buyback guarantee on such loans?

The buyback guarantee that we offer for our range of Cash-Free loans is done in partnership with the real estate developer that is selling the properties these loans are used to finance.

Investment in these loans is essentially risk-free for investors, because should a borrower default on the loan the developer will repay the money that investors originally loaned to them.

This is unique to this type of loan because the loan purpose was to reserve the purchase of a new home, which in cases of default would mean the property developer would find a new buyer for the property. This new buyer would then obviously pay the developer the reservation fee, meaning that no one really loses out in this scenario.

As such, this particular type of buyback guarantee would not probably be extended to any loans that were not linked to some purchase of a physical asset or property, which the loan could essentially be secured against. The pros of our current buyback scheme are huge for investors, as it allows them to earn the high levels of returns associated with p2p lending, but without the risk of losing the amount they invest should a borrower default on their loan.

There aren’t really any cons here, as unlike a provision fund or guarantee scheme this form of investment protection does not decrease the profits earned by investors.

What are the main risks for the fintech industry in a banking crisis similar to that of 2008 or that of Cyprus? How do you see the fintech industry in general weathering such a storm?

One of the main advantages of p2p lending that I touched on earlier are exactly related to

minimising the risks of a future global banking crisis. Because of the fundamental differences

between p2p lending and the traditional model of banking, where short term deposits are used to fund long-term investments, the type of ‘casino banking’ that caused the global financial meltdown in 2008 simply ceases to exist. At least, if p2p lending stays true to its roots, which is not necessarily the case with other platforms!

In general, I think the major issue with FinTech firms and p2p lenders specifically is the trend

towards ‘reversion to the norm’ and absorption by the mainstream financial industry. By this I

mean that much of the innovation and new possibilities associated with p2p lending and FinTech in general – the most notable of which are better products, services and prices for everyday consumers – will be lost or substantially diminished as the innovations are absorbed and bought out by mainstream financial institutions.

On the other hand, previously innovative p2p lenders are now increasingly drifting towards

becoming mainstream financial institutions themselves and replicating the behaviour and

practices of banks that made them inefficient and mean they provide a poor deal for average

consumers.

The final risk for p2p lending platforms, including ourselves, is the overall profitability and

sustainability of running such a platform, due to the lean model and thin profit margins.

However, in this regard we feel we are in an extremely strong position due to our ability to

create new revenue stream through innovative partnerships and our core investment from the EU’s innovation fund.

What are the plans for the future of Žltý melón?

For us this is an incredibly exciting time, as after building our core platform and offer through

the first 4 years of operation, we feel we are ready to really take the next big step in our

development.

There are two main aspects here that we are particularly excited about.

Firstly, we have proven the success of our model through our successful partnerships with real estate developers and the retailers that we work with to offer our innovative Cash-Free loan products. This has allowed us to conclude several new similar agreements that we will be

announcing shortly and that will be available to investors in the first quarter of 2016.

However, unfortunately I can’t reveal any more details at this point due to confidentiality agreements with those partners!

The second key focus for us in 2016 is clearly international expansion. Crucially, this has two

parts for us, which we will be following at the same time in order to stick to our model of

attracting both new investors and new borrowers at a steady pace.

The first part is really expanding our profile and marketing activities across the EU to attract new investors, especially in countries like the UK where we feel the p2p lending market has become stagnant and we can offer investors significantly better returns than the established domestic firms. The second part of our expansion strategy is to expand our lending activities in the CEE (Central and Eastern European) economic area, where p2p lending has yet to gain real traction and the current state of the banking sector in many of those countries makes borrowing from us particularly attractive for everyday people.

How do you see the fintech industry developing in Slovakia and the Czech Republic?

Obviously FinTech and the start-up culture that surrounds it has taken a bit longer to get going in Slovakia and the Czech Republic than in other countries, but that also means that the last few years have been, and the next few years will be, particularly exciting with lots of new innovation and activity.

One of our key advantages right now is that we are the only p2p lender in Slovakia, and there is also relatively little established competition in the Czech Republic as well. This means we have been really able to establish ourselves as the dominant player here, trust by both borrowers and investors. Also, the close proximity between Bratislava and Vienna is a big advantage for us, because the FinTech landscape is much more well established there. This is especially true in terms of innovations payments technology and so we are well placed to tap into that ecosystem,which will allow us to improve the cross-border payments experience for our users. So, I would say that while the FinTech ecosystem is young here, it is definitely very vibrant and there is lots of opportunity for huge growth in the coming years.

How has the harmonization of financial industry standards enabled platforms like yours to operate? (for example SEPA) Do you see other EU-wide reforms which might advance or hinder the fintech industry?

Changes at the EU level obviously have been happening a bit slower in some cases than many

people would like, but I think the overall attitude and support for reforms such as PSD II are

overwhelmingly positive and optimistic. We are the first true multi-country, multi-currency p2p platform in the world (to our knowledge!) which obviously wouldn’t be possible without things such as the SEPA standards and other similar EU initiatives.

One thing that is a little tangential here, but that we are keenly aware of, is the ongoing Brexit

process and where that ends up leaving the UK financial sector and the p2plending/Fintech

industry in the UK. We think that already the wariness and uncertainty around Brexit has been a key factor in the decreasing profitability of investing on UK p2p platforms, which makes what we can offer UK investors even more appealing!

So while we obviously hope that the process of Brexit is a smooth one and that the UK will retain a tight connection with the EU, it is something that we are monitoring and that has provided us with an opportunity to capture part of that market.

Special thanks to Jos Henson of Žltý melón for his availability and detailed answers to my questions. This interview together with the extensive information on Žltý melón will help you in your due diligence when considering this investment.