Financial education is about listening to both traditional and alternative views on economics, money and investing. Differing views can either challenge or strengthen your current understanding of the how money works. The internet is a collection of thoughts and ideas, all competing for your eyeballs and brain time. The creators of these ideas have monetary objectives, political objectives and ideological objectives. The first step in digesting information is understanding the sender and their agenda.

The news has been rife recently about “fake news”. This to and fro between the two camps is a turf war for the attention of ideas. I, Jim Reynolds have a deep passion for resilience and investing, and this drives me to have my ear on the rail track to listen to the incoming trains, phantom or otherwise. It is your responsibility to sort the real from the fake.

In my view, investment diversification should be considered from asset types and also economic views. This spreads risk to differing alternatives of the future, where different forms of investments thrive under different conditions.

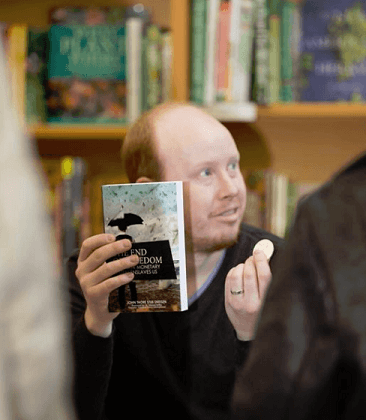

Today, this is why I sat down with John Sneisen, the founder of the organisation the “Economic Truth”, whose objective is to explain their views on economics and the financial system.

Enjoy this fireside chat, while you are reading I invite you to reflect on what parts of your current understanding of the money cycle are being challenged. I hope that this interview will trigger your financial curiosity and leaves you with more questions than answers. Consider these questions as spades, waiting to dig deeper in the concepts raised below.

Interview with John Sneisen, exploring alternative investment ideas.

You are the founder of the organisation “The Economic Truth”, how did this happen?

It started back in 2008 when I lived in Norway and attended a Network Marketing event in Phoenix, Arizona. The keynote speaker at this event was no other than Robert Kiyosaki. Robert’s speech detailed the hard truth about the cashflow quadrant. This prompted me to read his book “Rich Dad Poor Dad”, among many other Rich Dad books. I read them all and then I read “Investing in Gold and Silver” by Mike Maloney. Mike’s book covered the monetary history and economics in today’s society. This brought me to read many different books on money and economics. About 2 years after that I said to myself, “There has to be a way of sharing my knowledge with others”. At that point in time I saw this as my responsibility to bring this information to the masses. During this period of my life, I was working as a Syndicated Mortgage Broker and analysed Government run investment plans. I decided to put together The Economic Truth and share my knowledge with everyday people, as an attempt in making their life a little safer by understanding the repeated historical event that will occur throughout their lifespan.

What is the key message and objective of “The Economic Truth”?

The key objective is to educate people about the world around them and how their money is effected by changes in the world. Showing them the importance to understand history, trends, and geopolitics affect on their portfolios.

What are the main differences between your views of our economy today and those of the mainstream financial media?

- I have not gotten indoctrinated at a bank or investment firm.

- I am not a brainwashed PHD in “Keynesian” Economics.

- I have studied monetary history not only back to the great depression but to the creation of money which occurred 1000’s of years ago, in China.

- I am not locked in to one point of view. I combine all knowledge from Keynesianism to Voluntarism. I have studied over 15 proposed economic systems, both monetary and non-monetary.

- I do not think short term. I look at historical cycles, from hundreds of years to monthly cycles.

- I look at all financial assets and don’t focus on one or a few markets.

- I look at policies today and similarities to those used by governments both hundreds and thousands of years ago, which can predict responses by our current day’s governments and economies.

- I am not lobbied by big corporations to push certain assets.

- I look at non-monetary events causing monetary turmoil.

Investitin.com plug: Alternative assets investment opportunities can be found here:

Chaotic times have been predicted since Malthus, why is it different this time?

When it comes to the Malthusian theories on population growth vs. agriculture, I agree. As a society, we have innovated our way past that, but if we keep letting agriculture becoming deserted as we are moving more and more into cities, this will happen. We can innovate our way out by localizing agriculture. The Malthusian belief that agriculture was the driving force of population growth may have come from The French revolution, which was caused first by a volcanic eruption in Iceland. This created food shortages in agriculture in France, collapsing tax income for France and forcing confiscation of Vatican property used to back the French Livre. The French government then issued French bonds and the creation of currency eventually created hyperinflation which lead to the collapse of the value of the French “assignate (livre)”. You can see how a natural disaster far away created the collapse of the French currency and the coup of Napoleon, which made a move back to gold and silver as the main currency. Evidence that there has been centuries of paper to precious cycles.

What I foresee is a global collapse caused by the collapse of the current world currency, the US Dollar. This will cause system currencies around the world to fail, and with this you will see elites create a global one world currency. This one world currency will be potentially backed by gold or a global fiat currency through Special Drawing Rights. The IMF will be the controller of this currency, which will devalue all other currencies. These currencies will be pegged to the world currency and will only be used by nations and elites in multilateral corporations. Economies world-wide will be stuck yet again with worthless currency.

Studying history, we are taught that it is important to hold investments that protect you against the failure of paper currency and systems around them. I have come up with important information on how people can survive an economic collapse or central bank collapse.

- Wealth insurance through precious metals. Talking to recent survivors of a hyperinflationary currency event, they say people that held “Money” outside of the currency system became very wealthy. They used their wealth to by up other assets, while people were fire selling them to get enough food and water to survive from starvation. Paper investments can become quite worthless.

- Having a food and water supply.

- Owning land that has agricultural value.

- Being apart of a Whole Life Plan.

- Owning stocks in corporations that are on the commodity creation side that supports the above.

- Keeping money out of the banking system.

- Knowing that we will not have deflation even though we are in a deflationary demographic cliff. If this happens and elites pull the plug, we would, of course, have a mass bankruptcy of over indebted individuals, corporations and governments. I see a centrally planned printing QE, a Helicopter drop of money rather than a collapse, that ends in mass bankruptcy around the world, as the value of the currencies of nations hyperinflate to cover up mass indebted nations.

In your opinion, what are the largest dangers which the retail investors are underestimating?

Thinking it is smart to give their money to any professional and not carefully selected ones. Most professional financial advisors sell products and earn commissions from those products they sell rather than on the advice they give.

Some Advisor’s, do not research products that they promote to their clients. Believing that they are investing for the long term in a “well diversified” portfolio, while not being truly diversified investors. There are no 60-40% investment in bonds vs. stocks. The rich are very well diversified they invest in gold and silver; they buy businesses, fine art and cars, agriculture and crypto currency. I say you need to become a sophisticated investor today as most investments are not available to most retail investors. Get financially educated and understand how different assets works and their risks.

Investor’s main concerns/questions should be:

- What is the investments exit strategy?

- What are the fees associated with the investment?

- Is your portfolio diversified? (not just diversified in one asset)

- What is the term of the investment?

This will help you to truly mitigate your risk. Advisors and wealth planners might hate you for this, but you need to protect your wealth.

One last thing. When you invest, ask yourself, do you want to earn compounding profits? When you borrow, do you want simple interest?

You have recently published “The End of Freedom: How Our Monetary System Enslaves Us (The prepper’s guide to surviving economic collapse and loss) (Volume 1)” – Will readers look at the financial world differently after reading your book?

Yes, in my book I focus on our monetary system and our currency system as this is the system of use in all your financial transactions. I go deep into how our system of currency(money) works and how the odds are stacked against us. We need to be intelligent investors. The reason we invest at all is because of the cause of inflation created by central banks printing of money and debt creation. Our investing is caused by a cancer that is the fractional reserve banking system which create unbacked debt liabilities increasing the supply of currency while destroying its value. Modern pharmaceuticals mostly treat symptoms not the cause it self. The root cause of the need to grow your money is to beat inflation which is caused by the above.

I want to give you the historical view! As Churchill said, ““The farther back you can look, the farther forward you are likely to see.”

Investing is sometimes about the short term, but wealth preservation is about the long term!

You can follow John Sneisen on Twitter:

and Amazon:

We thank John Sneisen for the interview.

See Also:

Mike Maloney, the hidden secrets of money series.