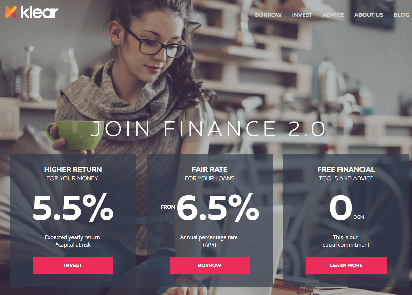

Investing in Bulgarian p2p loans

with KlearLending

What problem is Klear trying to solve?

If you deposit money in your bank, you get less than 1% return per year. But ask for a credit and your interest rate will be in average above 10%! The gap is big. For sure, there is room to give better conditions in both cases.

What is the scale of this problem?

The outstanding of consumer credits in Bulgaria (excluding mortgage loans) is around 5 Billion Euros.

Can you tell us more about the management and key staff in Klear?

We are a team of professionals coming from the consumer credit business, mainly BNP Paribas Personal Finance Bulgaria, the market leader (known as Cetelem in some other countries). For example, Nikolay was the IT development team leader, Lukasz was the CFO then the Chief Risk officer and I myself was the CEO.

What are the risk and reward ratios for loans on your platform?

We only serve Prime borrowers. Their average interest rate is 7.5%, well below the banks to ensure positive selection. We forecast an average yearly loss of 2%, which leads to an expected net return at 5.5%.

How reliable is the risk assessment for these loans?

Very reliable, for 2 reasons.

We have our credit scoring model based on our lengthy experience in this market, using socio-demographic data and credit history. Based on the score, each applicant gets a segment from A to D and the interest rate depends on it

Besides the credit bureau managed by the Bulgarian National Bank, we consult various official external databases like the National Health Insurance where we can check the salary and the employment history of any person. We also check the validity of the ID card in the Police Database.

How much skin in the game does Klear have on average in each loan?

We pre-fund the loans with our own money. So, we have skin in the game. Currently, we own the main part of the portfolio as we recently launched the investing platform (in November 2016). Even after reaching a faster pace, we will still own a part of the portfolio.

In which currency are the p2p loans denominated?

Loans are financed in Bulgarian Levas (BGN), a currency which is pegged to the Euro. The exchange rate has not changed since 2001 (1.95583 BGN for 1 EUR), which means that there is almost no currency exchange risk when investing in Klear loans, now and in a foreseeable future.

How do you source the loans?

For more than one year, we have created in our website a lot of content around personal finance and budget management. This serves as inbound channel to acquire borrowers and investors.

We are very active in social medias and we do online advertising.

Do you plan to have multiple loan providers on the platform?

No. We are the sole online provider of consumer credit to prime borrowers in Bulgaria and we ambition to reach a significant share of this market in the long term. Besides, we don’t want to offer pay day loans or any kind of small cash loans at horrendous interest rates.

Which type of loans have the highest demand from investors? Is this demand greater than the supply?

The demand from investors is evenly spread among risk segments and projects. Shorter durations are slightly more demanded by investors.

We opened the investing option a few months after starting giving credits to borrowers. We did that to have an already active marketplace. Now we still have a lag (more money lent to borrowers than money received from investors) but we are catching up progressively.

Can you share some of the highlights which brought Klear to where it is today?

First there was this tipping moment when we decided to leave our comfortable jobs and create something new, better, with purpose.

Important milestones were our participation to the FinTech accelerator The Spot, the agreement from the Bulgarian National Bank and of course the full launch of the platform in November 2016.

But maybe, this one, we’ll remember for a long time: at the eve of Christmas, at 16.30, we received a bank transfer of 50 000 Euros. No it was not a mistake, “just” one of our early investors sending money a few weeks after having started testing Klear. Woow!

Where is Klear going in the future?

We plan to expand our operations in other countries, offering the best on line credit solutions to Prime customers in Central and Eastern Europe. Poland for example is at the top of our list.

What kind of guarantees if any are the loans backed by?

There is no guarantee. This is unsecured consumer lending. We are targeting Prime borrowers. It makes no sense to ask collateral to this segment of customers as the only result would be anti-selection.

Who is the typical borrower for each risk category of loans you offer?

The typical borrower for the best segments A and B (which represent 80% of the portfolio) went to University, has a stable employment for a few years, a proven income above the average and a perfectly clean credit history.

Segments C and D concern borrowers with less stability or with some issues in their credit history. But these issues should be light and not recent. In any case, we never finance customers in delay, overindebted or with serious delay occurred in the last 2 years.

Other Platforms are offering buy back on defaulted loans, in your opinion what are the weaknesses of these schemes?

It’s a different model. Buy back guarantees exist when the loans are payday loans or for subprime customers. The interest given to the investors is usually a fraction of the interest paid by the borrower, a small fraction indeed in case of payday loans where interest rates are with 3 digits or more.

Basically, the risk is transferred to the guarantor, usually the originator of the credit. So, the safety of the investments finally depends on the financial strength of the originator. The more they focus on subprime lending, the more sensitive they could be to economic downturns.

Besides, if the interest is also paid when the loan is bought back, then it really looks like a bank deposit. Regulators may react as this product is quite far from the original peer to peer idea and way closer to the bank deposit.

What does it take to be a successful business in the Bulgarian market?

Like everywhere, I think, by gaining the trust of your customers. We try to do it by being fair and fully transparent. We have a kind of rule of thumb in Klear. When we think about building or doing something, we ask ourselves if we can explain to our customers what we are doing and why. If we don’t feel comfortable, then maybe we should not do it… That’s the rationale behind our name.

Where can potential investors find out more about Klear?

Visit: http://www.klearlending.com

We thank Loic Le Pichoux for this interview.