Landbay offers mortgages to BTL (buy to let) landlords. When investing with Landbay, Investors participate in crowdfunding of these mortgages. The minimum investment is £100 and then in increments of £10 thereon.

Landbay mortgages are backed up by real property, which gives the investor a level of reassurance that the borrowers are committed to bay back the loan.

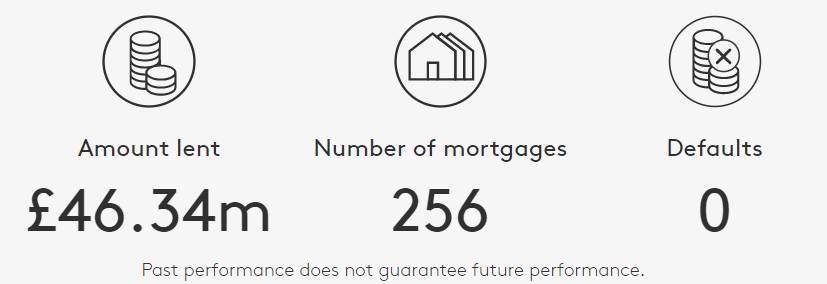

Launched in 2014 Landbay has financed more than 250 mortgages to date.

Landbay has two products one is an interest rate tracker 3.40% annualised, which is the equivalent of a variable rate mortgage and the other is a three year fixed at 3.75% annualised interest.

Opportunities and Strengths

- The loans are backed by property and the average loan to value ratio is around 68%. This should comfortably absorb any reasonable price corrections in the property market.

- Property is an asset whose existence can be easily confirmed and it’s valued objectively quantified.

- Rents on the property being mortgaged are also used as guarantees for the mortgage. One of the loan conditions is that rental payments need to be more than 125% of the mortgage payment.

- A provision fund provides further risk mitigation for investors’ funds. This fund could be used in case of a mortgage default and the assets used as guarantees cannot pay back the investors (lenders).

- The loan agreement is between the investors and the borrowers. This structure is safer for investors. In the unlikely case Landbay defaults, their loan agreement with the borrower will still stand.

- Landbay is regulated by the Financial Conduct Authority Regulated (The FCA is not a governmental authority), this does not imply that the government guarantees the lent funds.

- As at May 2017, Landbay has no defaults. This shows that Landbay has an excellent track record in choosing the right loans.

- When funds are invested, they start earning interest within 24 hours.

- Investors can use the auto-reinvestment tool which will automatically reinvest any interest earned.

- Both Fixed and Tracker Investments offers Investors the option to exit their loan agreement early providing funds from other investors are available to replace their loan parts.

- Interest payments are credited promptly on the first day of each month.

- Investors can invest in LandBay through an ISA. The minimum investment for an ISA £5,000

- At times Landbay has special offers to new customers and cashback offers.

Weaknesses and Threats

- When funds are queued in the classic account (fixed or tracker) to be invested, Landbay offers cashback equivalents to the potential interest earned. This is not the case for funds being invested via an ISA.

- Landbay does not yet have an approval for an IFISA.

- If Landbay were to cease operating, there are business continuity plans in place which protect the interests of investors and allow the loans to continue functioning as per the established contracts.

- In the case of an economic downturn, property prices can decline. This is because there will be less demand for property and there the spending power of tenants would lessen.

New regulation intended to limit BTL investments and property speculation could reduce the take home of landlords and the values of the property. - Landbay has a focus on residential property. This focus is an advantage because it can bring more insight into a single market, on the other hand, it also concentrates capital in the residential market. This is a weakness only if investors invest 100% of their funds in Landbay.

- Dealflow on Landbay has declined in 2016. BTL mortgages are a complex process, which requires finding the right deals and then process them through a thorough due diligence process. Recently, Landbay has hired Paul Brett and launched a more user-friendly intermediaries website this should increase their deal flow.

Conclusion

Landbay provides access to a specific residential market niche, it does so in a low-risk manner and this is reflected in the lower returns when compared to other p2p lending providers. However, higher returns from the competition should be compared to the risks that the capital is exposed to. Landbay is a balanced risk to reward investment opportunity. Capital is at risk.

Learn More: