NSR Invest – A LendingClub and Prosper Investment Manager

Interview with Summer Tucker Investor Relations Director at NSR Invest

Peer to peer lending is a new asset class, which in the last few years has opened up to the retail and institutional investors on a massive scale. This asset class creates loans between borrower and lender without having traditional banks acting as middleman. These transactions create an opportunity for borrowers to have loans with lower interest rates and to investors to invest in loans which were previously not accessible.

Lending club is a peer to peer platform, which acts as a middleman between the borrowers and the investors. The investors have to manage the incoming flow of loans in Lending club and select which ones to invest in, in order to maximise their profits. This task can be done by the individual investor, but NSR invest offers more efficient access.

NSR invest is a set of tools which assists investors both in portfolio analysis and efficient auto investment. The metrics provided by NSR invest are the best in this class of portfolio analysis, taking information from more than 100 data points and they are completely free. The other advantage that NSR delivers to investors is automated investing, time and time again the secret sauce NSR employs behind their software has beaten the average returns by those who were not using it.

In the future they will be adding new Peer to peer lending providers, including Funding circle and more.

Lending Club and Prosper, Prosper is a more institutional oriented service.

Truth to NSR’s success is the amount of trust investors has put, NSR has more than $110,000,000 under management.

Investors have three main products to choose from with NSR:

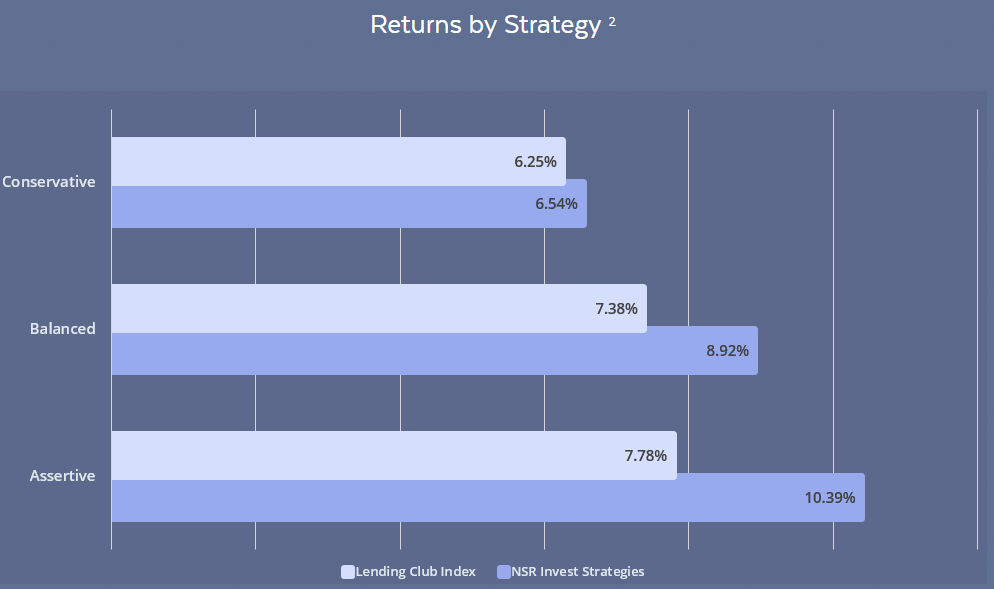

- Fully Managed accounts which can be set at Conservative, Balanced , Assertive strategy.

- Recommended minimum of $10,000.

- Self-directed accounts where the investor uses NSR’s tools to design their own investment strategy.

- Lending Academy p2p fund; minimum of $250,000

When using NSR investors, have several advantages: industry leading analytics, fast execution speeds, automatic investing, and the option to use NSR’s proprietary algorithms to increase portfolio performance. The dedicated success team within NSR makes sure that investors have what they need to make their NSR investing experiences a success.

Rating of Lending Notes

On LendingClub each note has a rating which reflects the risk/reward ratio for that particular loan. The risk is that of default and the reward is the interest rate which the loan provides.

NSR invests targets the top 10% of the notes issued by LendingClub. This is because even though LendingClub creates it’s own rating of a note, NSR performs additional analysis, and the system can decide if the risk/reward is favourable to it’s customers. This analysis is automated using robust analytics, proprietary algorithms, and their leading order management system.

The rating of notes, is subjective there is no set accounting system on how to analyse the risk/reward ratio. NSR has only one customer and that is the investor, thus all its efforts are focused in the interest of the investor’s profit.

Speed of Execution:

The first step in profitable investing on LendingClub is choosing the right notes, which NSR does by its analysis as described above. The second step is actually buying those notes. This is where speed of execution makes the difference. NSR’s systems successfully bids on approximately 98% of the notes they target in the fractional pool.

[perhaps explain whole vs fractional pool here but it doesn’t really relate to your audience and since there is only 1 winner on the whole loan side, the bid success rate is lower]

Hands off p2p investing:

The lending market is changing according to the regulators, supply and demand. These variables change factors such as the risk/reward ratio for investors. As an individual investor’s, monitoring such trends is a very time-consuming process, through NSR investors can rest assured that someone is looking after them and choosing the best notes for them according to the current market environment.

How do investors get updates on their portfolio performance? 24/7 access to portfolio performance through their NSR account and monthly statements are provided by Lending Club.

Secondary market:

NSR invest has a secondary market facility to trade notes. Investors can buy and sell notes to each other. Given there is idle cash in LendingClub accounts at the time of writing(May 2017), this facility is oriented towards those would like to make a profit by trading the notes themselves rather than on the interest generated by the notes. Prosper does not offer secondary trading.

2. NSR Invest strategy performance reflects backtested results only – not an actual composite of managed accounts. Assumes NSR Invest fees of 0.60% per year and idle cash drag effect of 0.25% per year. Lending Club strategies are weighted to reflect the approximate distribution of Loan Grades for each NSR Invest strategy. Interest rates and ROI calculations reflect current Lending Club rates as of 10/1/2016. Rate increases assumed to increase net ROI by 2/3 of the effective rate increase or decrease. Past results are never a guarantee of future performance.

NSR invest fees:

- Self Directed accounts: 0.45% annually

- Fully Managed Accounts : 0.6% annual fee

- Lend Academy p2p fund: 1.5% annually

Conclusion

LendingClub and Prosper are new and powerful investment vehicles, using them on their own brings investors the benefits of diversification and yield. These benefits can be amplified by putting NSR invest in the driving seat. Investors will directly benefit from the experience, skill and systems that NSR has.