Eric Teng is the CEO of CrowdTo. In this interview, he explains more about their peer to peer property investments, and how international investors can access this market.

Can you tell us about this history of the CrowdTwo?

We started CrowdTwo because we realise that even average working people would like to try investing in properties, but without the high capital requirements and associated risk involved in purchasing the whole property themselves. We recognise such a need, and therefore CrowdTwo was created.

Which legislation regulates CrowdTo?

At the moment, Crowdfunding is not regulated in Singapore. We are a legally registered company.

Can you tell us more about the management of the company?The team has been heavily involved in various startups for many years including property portals in other countries, one of which is currently valued at USD$5 million dollars. We have been really interested in the property industry because the market size is huge and sufficient to accommodate multiple players in the space.

The team has been heavily involved in various startups for many years including property portals in other countries, one of which is currently valued at USD$5 million dollars. We have been really interested in the property industry because the market size is huge and sufficient to accommodate multiple players in the space.

What are the advantages of investing in Singapore and in Singapore real estate?

Singapore real estates are generally speaking very stable because of government control and stable economy. There are lower risks compared to other developing countries but this also means that the returns tends to be lower. Singapore is also a very small country so the amount of real estate is limited, while demand isn’t.

What are the strengths and headwinds of the Singaporean dollar?

The Singapore currency has always been very stable and strong due to a stable strong government. This reduces the risks of currency volatility and fluctuations.

What are the maintenance costs on the property investments?

This varies between different properties. For example, condominium includes monthly management/maintenance fee. There is no such fee for the land investment we had.

Are there any restrictions as to whom these investments are open to?

At the moment, we don’t have any restrictions.

Does CrowdTo or its management invest in these projects?

Yes, we are financially vested in the projects. This keeps us aligned together with our users. We have a majority stake (over 50%) in certain project.

Who can participate are there any restrictions? (USA residents?)

At the moment, we have no restrictions although we advice our users whether it makes sense for them. For example recently, someone from Holland contacted us and we realise that the returns are not likely to meet his expectations and so we advice him not to do it.

What will investors own – shares in SPV (Special-purpose Vehicle) or a will their ownership be registered in the land registry?

They will own shares, and these are recorded in CrowdTwo database. Users can login online to their account to see their portfolio live anytime. The ownership will not be registered in the land registry because it won’t make sense to do so. The whole idea of CrowdTwo is so that users can buy say $10k worth of properties and able to sell $3k of it next week if they realise they needed the money urgently.

Can you provide any information on the returns on any of these projects? Which ones have been rented and what is the ROI?

The ROI is around 6% on average. And to show users we do actually own the properties; we show the property deeds to the users if they are truly interested in it. Other than that, most information is private and confidential.

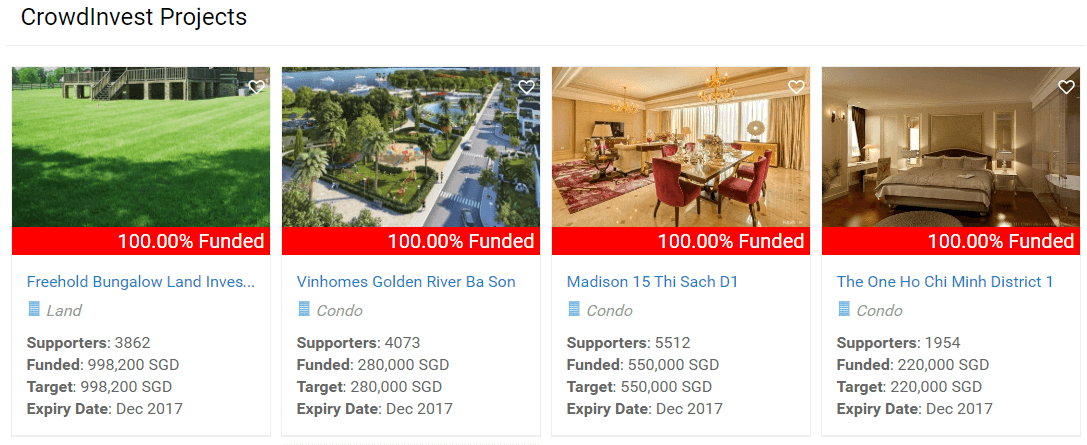

Interested investors interested can see the: Singapore peer 2 peer property investments list.

We thank Eric Teng for the interview.