Swaper.com is a new player in the p2p space; it offers payday loans at 12% interest.

What is the story behind Swaper.com ?

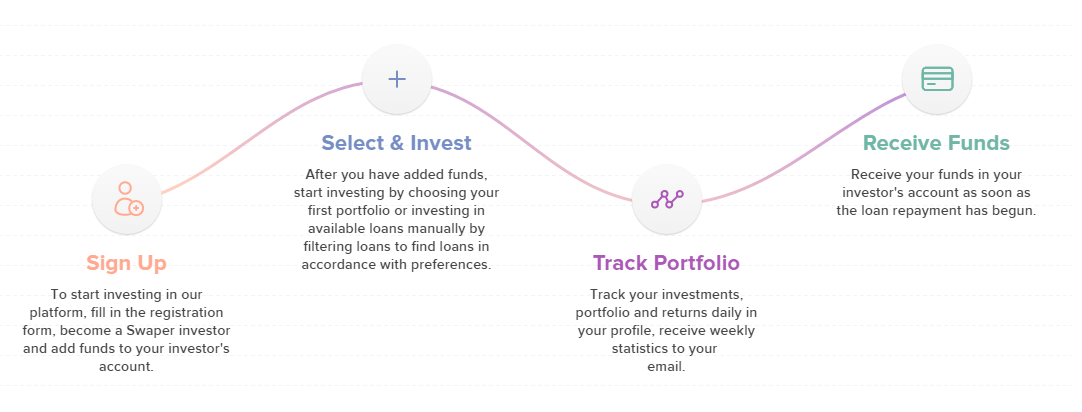

We are a team of field professionals, who have an extensive experience, working at 4finance, Twino and other leading financial companies. Wandoo Finance Group and also Swaper project were launched with the idea to build better financial products, based on our previous experience, because we know, how to make it better. The company was established on February 2016, and in first nine months since establishment, we have launched two payday loan companies- in Georgia and Poland. We have issued loans from our balance sheet, and to develop our business, we have launched Swaper on 5th of October as one of the fintech product- a P2P Marketplace, where we offer to invest in payday loans, originated in Poland and Georgia, with interest rate 12-14%. We offer BuyBack Guarantee for all investments, what means no risk for investors. If a loan in Poland or Georgia has not been repaid, the investor receives all invested amount and also interest back.

We differ from other competitor platforms with development process- we asked investors, what is important for them and made the platform on the base of their needs and preferences. Thus we have a product, which is similar to other products that are available on the market, but as we included investor ideas, our platform is more user-friendly. Our key feature is Mobile App- asking investors we understood that it is

Our key feature is Mobile App- asking investors we understood that it is the necessary thing to have a Mobile App. None of the platforms has Mobile App at the time of writing.

Can you tell me about the people behind Swaper.com?

Swaper.com is a subsidiary of Wandoo Finance Group that is owned by individual – CEO Iveta Brūvele. We have 20 people working in our headquarters in Latvia who manage loan issuing processes and Swaper investment platform and total of 100 employees across Poland, Georgia and Latvia. More information about our management team is available on our group page www.wandoofinance.com

Is the technical platform self-developed?

Yes, it is. Our IT development team is based in Riga, Latvia.

What ROI can investors expect today and in the future?

Swaper offers 12% annually for our customers and 14% for our Loyal customers – participants of our Loyalty (VIP) program.

Do you source the loans yourselves or do you source them from third parties?

Swaper offers to invest in payday loans, originated in Poland and Georgia by ourselves- Wandoo Finance Group.

Do you plan to provide more information on the borrowers?

No, in the nearest future we do not plan to add more information about borrowers.

What are the three main advantages for investors?

A review of Swaper.com has to be considered in light of the following:

1. We are the first P2P Marketplace that offers customers Mobile App. Now the app is available for Android users and very, very soon it will be available also for IOS.

2. We offer Portfolio Invest, instead of investing in loans choosing them one by one. It helps to save a lot of investor’s time.

3. Loans offered for investments on Swaper.com are more secured because we are using different features in loan issuance process, which make it much more efficient. Features such as fraud detection tool, which gathers information about customer and device the customer came from, determines if anonymizators haven’t been used or another user hasn’t logged in recently from the same device. Wandoo loan issuance process is currently managed by linear models and machine learning algorithms. This allows us to predict the possible fraud cases and potential defaulting loans. In future, we plan to develop deep learning hierarchical decision models for more precise prediction and classification of loan issuing process.

How is the buyback guarantee ensured?

BuyBack Guarantee means that Swaper will compensate the investors both the invested principal amount and interest, as well as pay the accrued interest in case if borrower is late with the repayment for over 30 days or is prolonging his payback term for the sixth time.

Our APR for consumer loans in Georgia is 228%, and in Poland, 300%, interest that we are paying investors on Swaper is maximum 14% per year, what means that we have more than sufficient margin, from which we can cover unpaid loans and all other operational expenses.

Will Swaper.com publish the audited accounts in the future?

As we are a new company and started our operations in February, our first financial statement will be available at the beginning of next year, and we will continue to publish information every year. A review of Swaper.com at this time has to be considered against the highlights discussed above. New players in the industry are the biggest source of innovation.

By which jurisdiction is Swaper.com regulated. ?

Swaper is operating according to the legislation of Republic of Latvia and regulations of Customer rights protection centre.

Comments: What has been your experience Swaper.com ?