Swisspeers offers peer to peer loans for SMEs in Switzerland. It was launched in 2016, and to date has issued a total of more than CHF 7’000’000 in loans. Their primary target market is SMEs which require capital to expand, replace equipment and want to expand internationally. In this interview, Alwin Meyer of Swisspeers has answered a few of our questions.

What is Swisspeers about, what is the elevator pitch?

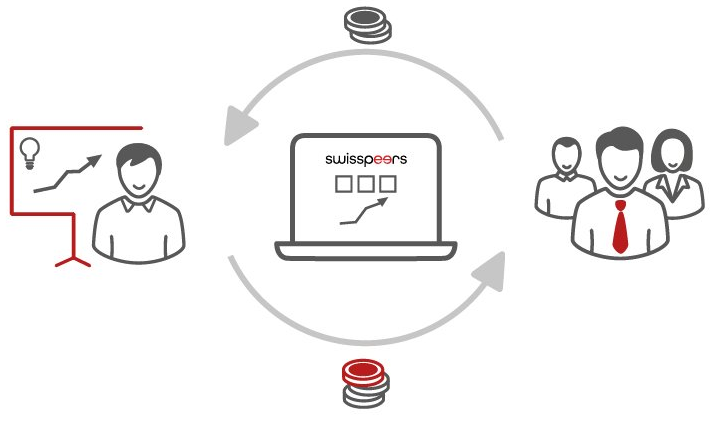

Swisspeers is an independent crowdlending platform for Swiss SMEs. It allows small and medium-sized enterprises (SME) to acquire debt capital from investors directly – without the intermediation of a financial institution.

Who can invest in this product?

The investment is primarily targeted to private, institutional, and corporate investors based in Switzerland. EU-based investors do currently not have access to the investments.

How does the auction system work for investors?

As a borrower, you will first get a provisional interest rate according to the credit rating. The final interest rate will then be determined through the auction, after publishing the crowdlending campaign. If demand is significantly higher than supply, the provisional interest rate can decrease. So, investors have an impact on the final interest rate.

Does Swisspeers have an Auto-investor tool?

Not yet.

What is the payback structure and schedule?

The SME loans mediated by Swisspeers have the payback structure of a fixed rate annuity. Swisspeers loans provide the investors with monthly payments and a steady cash flow starting from the first month.

What are the average interest rates for fixed deposits for 6 months, 1 year and 2 years in Swiss bank accounts?

At this time in most cases, rates are 0% or even negative.

What is the interest rate paid to investors?

Depending on the credit worthiness of the individual borrowers, the interest rates vary between 3% and 13%. Collateral might reduce the rate.

What is the minimum investment in each loan for investors?

The minimum investment in a loan is currently affected by Swiss banking law. Therefore, the minimum investment must not be smaller than 1/20 of the loan size.

What is the average loan size?

The average loan size is CHF ~120’000. (110,554 Euros)

What kind of guarantees do the loans come with?

The loans are non-secured but depending on the borrower we secure them by pledges, guarantees of payments, or letters of subordination.

How are loans are given their credit rating?

The credit rating is primarily defined by the creditworthiness of a borrower and his capacity to borrow. (see above)

If you had a magic wand and could change anything in the Swiss fintech sector what would be the first thing you would tackle?

If we had a magic wand, the first thing we would tackle would probably be the Swiss banking law. Deleting the limiting factors around the number of investors per loan would be a big step towards the decentralisation and liberalisation of Switzerland’s credit business.

We thank Alwin Meyer for the interview.