Gold is a precious metal and noble metal. This “preciousness” is why gold is valuable. However, this value is subjective. Different individuals do not value the properties of gold in the same way, either because they are not aware of why these attributes are valuable or because they do not see the value of these attributes today. This article highlights the pros can cons of Gold objectively; it is an excellent primer that gives insight on why some investors love gold and why some others consider it a “barbarous relic”.

Advantages of investing in Gold

- Today (March 2018) Gold coins are easy to acquire. Premiums for currencies differ between dealers, but the internet makes finding the best deals easy. These coins are a recognisable form of value anywhere in the world.

- Investors can avoid the fluctuations in gold price by dollar cost averaging, their purchases through periods of time, this avoids paying peak prices for the metal.

- Ownership of physical gold can be a hassle regarding storage and security. Gold dealers and Gold Vault companies today offer a turnkey solution to buy and store an investor’s gold. This does have risks, but some investors prefer the risks of vaulting rather than the risks of self-custody. Vaulting eliminates all the hassle and risk of: transportation, protection and good storage of gold.

- Gold tends to maintain its purchasing power over time. During Roman times one ounce of gold would buy shoes, a good suit and a belt and this remains true to this day. This attribute of gold offers excellent protection against inflation.

- The value of Gold is not regulated by Governments, although Governments can influence it through regulation.

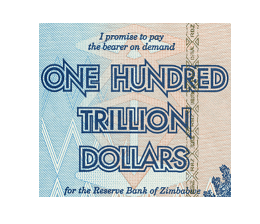

- Gold is considered as a safe-haven asset, meaning in times of turmoil investors tend to prefer holding gold rather than currency. As a currency is dependent on third parties to retain its value.

- Gold itself cannot be hacked. (Although vaulting company records can)

- Jim Rickards makes a solid argument when stating that no other metal in the periodic table is more suitable than gold to function as money. Some elements are radioactive or poisonous; others are in gas or liquid form which makes them difficult to handle and out of the noble metals Gold offers the best balance between scarcity and stability.

- In certain countries, gold sales are not subject to VAT (Value added tax).

- Several central banks are increasing their purchases of Gold (some others are selling it), this gives Gold gravitas in the international financial system.

- The value of Gold is not dependent on a counterparty. National currencies value are a factor of a country’s ability to collect taxes, build and maintain infrastructure, level of business friendliness, interest rate on national debt, political systems transparency and protection of property rights. Gold’s value is not dependent on stability, strength and competitiveness of any third party.

- Given that some Governments hold huge reserves of gold, they have an interest to see that gold’s value is recognised.

- Gold is money if it was not central bankers would not care about the price of Gold.

- Gold cannot be destroyed.

Disadvantages of Investing in Gold

- Numismatic coins can easily be confused as bullion coins. Numismatic coins value is only partially based on gold content; the rest is based on the art and beauty factor of these coins. New gold investors can easily make the mistake of investing in these coins thinking they are investing in gold.

- Vaulting is not free. The cost of Vaulting varies.

- Not all Vaulting companies are made the same; some have more stringent testing procedures for incoming gold than others. These procedures ensure that the gold in a vault is indeed gold not tungsten.

- Some Vaults require a minimum amount of gold to be on the account and a minimum vaulting fee; this makes storing small amounts of precious metal un-economic. Check the fee carefully.

- Larger gold bars can be difficult to sell if they are not in the LBMA approved vaults

- Gold does not generate yield.

- It is impossible to know if the in the long term investors will prefer other forms of money which have similar attributes to Gold such as Bitcoin or Altcoins. Are these new types of assets better suited to be safe heavens than gold?

- Silver is another precious metal, that has many industrial uses. These industrial processes consume silver and remove it from circulation making it more scarce. The used silver is not economically recyclable and in many cases physically impossible to retrieve. In the far future silver could become more precious than gold.

- The stuff is heavy to carry around.

- Moving across borders with gold bullion can make the carrier a subject of interest.

Opportunities when investing in gold

- Financial instruments such as GLD allow investors to quickly buy and sell gold, removing all the troubles associated with managing the physical stuff. Owning GLD is not the same as owning physical gold.

- Gold miners, Leveraged ETFs, Inverse ETFs and Gold options on GLD and the miners provide an alternative to investing in physical bullion. These assets have different attributes to physical Gold itself but have a relation to its price.

- Some gold Miners provide a dividend.

- Gold demand is growing.

- Carrying gold jewellery gives the carrier a form of a recognisable asset which can be used in emergencies.

- Some Gold storage companies provide the facility to move gold from one account to another, this turns gold into a form peer to peer payment.

- Certain people claim that gold is manipulated down all the time if this is true at some point in the future the price suppression can no longer be maintained. (Math wins!) This phenomenon, if correct is providing a great buying opportunity to investors during this period. (March 2017)

- It could be that one day, some FIAT currencies will be backed in full or in part by Gold. In this case, Gold could go “to the moon” ($10,000 an ounce). (“To the moon” – is an internal joke among the gold and silver stacking community, which means gold will make them rich … one day in the far future).

- Fewer economically recoverable gold mining sites are being made every year.

- The easy to mine gold has already been mined.

- The price of mining gold is dependent on the price of oil. The price of oil can go exponential up either because of scarcity or economic growth. This would make mining more gold expensive, thus giving more value to the gold that is already above ground. See more on EROEI.

- Several mines, mine Gold as a byproduct of copper. Copper demand is mostly dependent on infrastructure growth. In an economic decline, some mines could be scaled back, resulting in a drop of Gold mined.

Threats to Gold investors

- Gold has been confiscated in the past.

- Governments with mega gold reserves could decide to sell and this would cause prices to plummet.

- A windfall tax is a special tax applied to specific situations. If gold experiences extreme price rises it could be the subject of a windfall tax.

- Gold’s role in a portfolio can be taken out of context if compared to investments with completely different attributes like stocks. Gold’s is strong where other assets are weak, and other assets are strong where gold is weak. Asking both security, yield and capital growth from an asset is asking for the laws of the universe to change according to your own will. Gold should be valued not for its yield but for its ability to never be priced at zero.

- The biggest demand for gold is in China and India and demand is increasing. India is actively discouraging Gold investing, and Chinese economic growth seems to be challenged in 2017. Demand for Gold from these markets has the potential to decline in the future, causing prices to decline.

- Given that gold does not have a yield, it cannot benefit from compound interest.

- Certain people claim that the value of Gold is determined through a system that can be moved according to the needs of certain agents within the gold price discovery system.

Do you have any other pros and cons to gold investing which are not mentioned in this article? Then add them in the comments.