How to invest it in Startups.

Syndicate Room is a p2p equity platform operating since March 2016. The platform provides access to public and private equity markets. The members of Syndicate Room can diversify through exposure to the startup asset class.

Executive Summary of the SyndicateRoom review:

- The importance Syndicate Room puts on having the right talent in each of the startup funding rounds

- Access to these investments without P2P equity platforms is limited

- VCs are a crucial part of the Syndicate Room funding rounds

- Syndicate Room has the vision to change the investment industry making it more versatile and transparent.

- There are different types of funding: Private seed rounds, Initial Public Offerings (IPOs), Growth and pre-IPO rounds and share placings to the public.

When Investing in early stage businesses there are risks. Shares are not tradable and thus illiquid. Startups are in the process of growing, so they focus their

Liquidity: Shares are not tradable and thus illiquid. Startups are in the process of growing, so they focus their

Shares are not tradable and thus illiquid. Startups are in the process of growing, so they focus their

Limited secondary Market access:

Startups are in the process of growing, so they focus their cash flow on growth rather than distributing dividends to their investors.

Dilution of Ownership:

Shares issued can be diluted when further rounds of share issuance are undertaken. Startups need money to grow, and one way to do this is by issuing more equity. More equity has the effect of diluting the previous shares issues.

All investments reviews on InvestItIn.com are intended for a readership of sophisticated investors and high net worth individuals. I do mention high net worth individuals for two reasons, usually high net worth individuals tend to understand money better and they can afford to loose more. Review each investment carefully before you dip your toe.

Review of Syndicate room with James W Sore Chief Investment Officer

What problem is SyndicateRoom solving?

SyndicateRoom is an online investment platform. It provides an open, level playing field where all investors, professional or private, have the same fair and transparent access to deals. Our investor-led(R) approach sees each round led by an experienced lead investor, this could be an Angel or VC. Accessing early-stage and growth investments at the same price as a lead investor is part of the unique proposition offered by Syndicate Room.

This model has helped resolve a problem that many early-stage companies face when raising capital. Entrepreneurs often have access to one or two angel investors, but finding additional investors can be tough. Angel investors, in turn, want entrepreneurs to raise additional funds by themselves, as this provides further proof of a company’s concept and plans.

We’re solving a problem for private investors, too. Often they don’t have the time to review hundreds of pitches from young businesses, so we provide an opportunity to select investments from a highly rationalised selection.

For those who don’t want to pick, we have also launched the first passive fund for early stage investing, Fund Twenty8.

What are the main advantages for investors in FUNDING campaigns on SyndicateRoom?

1. Early-stage investments provide an opportunity for long-term growth in today’s low-yield economic environment. We recently conducted research entitled Rise of the Growth Hunters, which looked at the growth rate of early stage companies. Beauhurst analysed the five-year change in valuation of a wide portfolio of 578 early-stage UK companies that received equity investment via seed or venture capital in 2011. Between then and 2016, the study found an average compound annual growth rate (CAGR) of 33%, compared to 5% for London Stock Exchange Main Market companies.

2. What SyndicateRoom’s model brings to the table is the knowledge that there is an experienced investor, or group of investors. These investors put their money into the deal and engage in the process. They conduct their own due diligence, negotiate the valuation, negotiate the terms, and then open the deal up to others to invest alongside them.

3. Access to a wide range of investment opportunities which span the risk ladder, from idea (early-stage private companies) to IPO (public markets). We also have Fund Twenty8 to bring multi-sector exposure and a large portfolio. Diversification is key for any investment portfolio, across sectors and geographies – and also the pure number of investments. Research suggests that 28 is the minimum investment portfolio size required to have a 95% chance of backing at least one company returning 10x or more. It was this research that led us to launch Fund Twenty8.

What are the main advantages for looking for those looking for INVESTMENT through SyndicateRoom?

1. Access to valuable investors. Our members are high net worth and sophisticated investors who understand the risks o early-stage investing.

Can you review some of the best success stories on SyndicateRoom?

We’ve raised for a large cross section of companies, from a Hollywood movie (Salty, directed by Simon West and starring Antonio Banderas), to many health care companies (including cancer treatment and rare drug discovery companies) which are aiming to make the world a better place. Lightpoint Medical is a great example, they have allowed surgeons to see cancerous tissue, live, during surgery. A total revolution in surgery.

In December 2016, SyndicateRoom celebrated its first exit when Oval Medical Technologies, which raised funds on SyndicateRoom’s platform back in 2014, was acquired by global medical device manufacturer, SMC Ltd.

What are your selection criteria to review applicants for Campaigns on SyndicateRoom?

We require at least 25% of the funding round to be committed by arms-length investors or if they are connected to the business, at least 50%. This means that the people saying the price, pay the price. There are a number of other nuanced and specific elements we consider, but that is the core requirement.

Is SyndicateRoom open to international investors?

Yes, we have investors from all nationalities and locations, but predominately they are UK based. This may have to do with the benefits of EIS which requires you to have income tax paid in the UK.

What advice do you have for entrepreneurs who aspire to get their next round of funding through Syndicate room?

Talk to our team! We’ll go through the details of your business and capital raising goals – and work out if we’re in a position to help you.

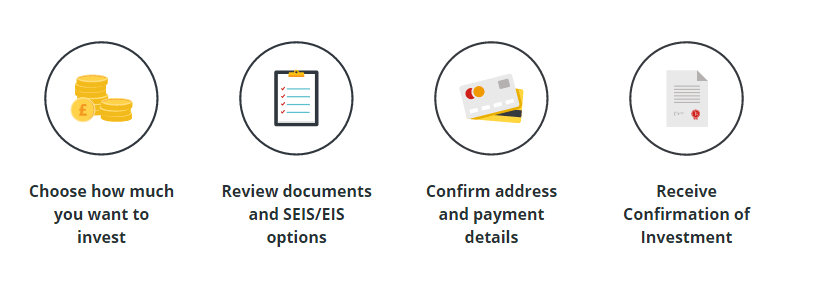

How to Invest In Syndicate Room?

Visit SyndicateRoom to learn more about the startups organising their crowdfunding rounds through this platform.

Comments:

Have you invested in Startups using SyndicateRoom? Which ones did you invest it? What was your experience?