WeTrust is a financial peer to peer platform in development. They plans to launch multiple projects related to finance such as Roscas, Insurance, p2p lending, all powered by Ethereum smart contracts.

The new WeTrust token distributed during the ICO has had several benefits such as increased visibility of the project and a community of investors now have a vested interest to promote this project. The token’s price will be tied directly to the efforts of the project not to the Ethereum ecosystem as a whole. The WeTrust token will be used to purchase access to the relevant smart contracts being used in the system.

The WeTrust team have collected $4,662,000 USD, in the ICO and the developers are keeping 10% as a founders reward. This amount locked for two years, which incentives the founders to complete the project. The pre-mine or founders reward is advantageous compared to other recent ICOs.

The first application of WeTrust will be a ROSCA. This system will allow a group of people to save money more consistently. Initally the group will agree to pay an amount of money in a pool at a pre-established interval. At each interval the person who pays less than the agreed amount will get the pool. The reasoning is that the person has the most need for money, needs the pot most.

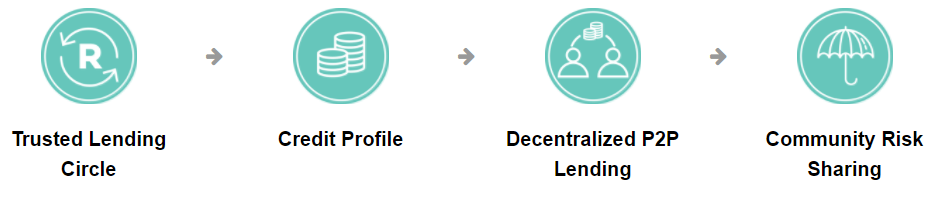

WeTrust will create other projects such as Credit Identities, Loan Portal and Mutual Insurance, however these projects are not on the Roadmap at this time. Will their creation depend on the success of ROSCA?

The value of the token is driven by pure demand for the WeTrust applications.

ROSCAs are mainly used by the cohorts in the lower income bracket who have trouble saving and use peer pressure to motivate them to save. WeTrust plans to expand this market and have people who do not necessarily know each other use their application to save money. The trust is delegated to the WeTrust platform and the savers can rest assured that the rules agreed will be followed.

At frist, the ROSCA app will work using the WeTrust token, the platform plans to bring in stable coins such as Tether. This will help the savers ensure that the fiat equivalent they put in can also be paid out. This is challenging. Tether https://coinmarketcap.com/assets/tether/ is a stable USD coin, which should mimic the price of USD. It has had fluctuations in the past. Bitcoin itself is being priced differently on exchanges who allow access to USD and to others who do not. Without price stability ROSCA users will be saving their money but also gambling their savings on the stability of the so-called stable coins.

It seems that there are no plans by the WeTrust team to share revenue with the token holders. In part this explains the favourable ICO conditions. The fees to use the ROSCA app are 2% to the ROSCA organiser and 0.3% to WeTrust platform.

Frugal users focused on savings could find the 2.3% cut too much to use this application. Although a 2.3% fee could out weigh the risks of not being paid and not being part of a ROSCA.

IT systems have the potential to be hacked, and WeTrust is no exception. Any such incidents will have an important impact on the value of the token.

If successful, WeTrust will build a lot of deep commercial value. There are many other opportunites they could exploit such as group buying, community currencies, targeted advertising and long term community investing such in shares of the local grocery shop.

The MVP or prototype is yet to be released.

It seems that WeTrust is being included in the ICONOMI crypto fund. This automatically adds investors which otherwise would have not considered investing in this project.

Given the global nature of WeTrust, it will also face regularity challenges in the various countries the application will be used. In some countries a money transfer license could be needed.

The team behind WeTrust is strong, GeorgeLi the CEO used to work at Google and the rest of the team have strong CV s with many industry names in their collective Cvs.

I wonder why a ROSCA application has not been picked up by Dash, it seems to have all the resources in place and the right target market for this kind of application.

More information on WeTrust:

Your comments are important and appreciated. What do you think about WeTrust? Have you invested? Why? What do you think about the team? Do you know of any good alternatives?